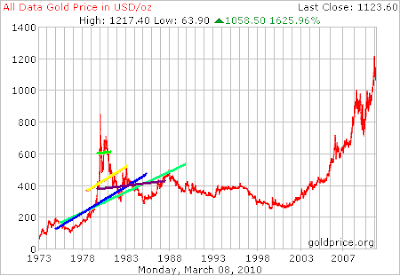

It's hard to take the 1980 gold price, and make that one data point, into an argument about "normalized Gold Price". There was a Jan spike and it was $850

It's hard to take the 1980 gold price, and make that one data point, into an argument about "normalized Gold Price". There was a Jan spike and it was $850

The argument is this.

The inflation-adjusted price of gold in Jan, 1980 was $2300 of today’s dollars. We are now 50% below that peak.

But if you are talking about half that price, or even $500 as a peak Average price, which gold averaged for 2 years. it's .6 of the peak, which would give you $1380 as an average price, You are still within, 20% of that price. and if you liken $400 to current prices, you are well within the model, with a current price of $1150. Matching the $400 1980 price.

And all of that assumes that "This time" will mirror, last time, in your Socio-Economic Pricing model.

All of this, out of something that, they continue to find more of, and that is not consumed.

No comments:

Post a Comment