1.8 Trillion in lossed leverage

200Billion at 9:1 in Fiat losses.

Financial history doesn't repeat itself, but it often rhymes. You can't be stupid enough to trade off anything I say.... I'm lucky they let me out of the straight-jacket long enough to trade.

J. P. Morgan

Friday, February 29, 2008

some rantings

you are about to get some personal stuff... I mentioned I had some stuff to do today.... So, I get a call....

and I'm going to a play, because someone wanted to go... and it sounded good.

"What time?"

"7:30"

"so we meet up and head over there at 7.. thirty minutes to get there."

"UMN... NO... See this is a play, one shows up 15 minutes early... we need to pick up the tickets at the door... 45 minutes to get there, drive time, late time, walk time. if we don't meet up by 6:30 there is no point. Not to mention.. how nice it would be to meet up, have a beer.."

"well but.. I have to X, then I have to Y... then I have to.... (basically your average chicken with a head cut off stuff)"

At this point I almost cancelled.. but I already paid for the tickets... and I fucking planned this, to my own chagrin... and once I say something is going to happen... I'm just not fucking around... That is for chicken with a head cut off people.

Right... you do something, to have a nice time, Step out of the house, get to the theater, mill around, Talk... the whole bit... and Suddenly we are Running around, going to be late... have shitty seats.. pushing people out of the way....

I sound like a car commercial... but life is a journey... not a destination. How you get there is as important as where you go.

one of those good calls from the ol' man

me,"hi..."

him,"slipping a little bit."

"yep, that happens."

"seems like the whole market is slipping."

"Ya.. umn when you see that DOW number... and ... well it's an index... indexes are measures of groups of things... Well when that index is down that means much of the market is down... next week we learn about the SPX and the Nazdaq....."

"you are an asshole."

I'm surprised he didn't want to buy... he always wants to buy at the beginning of a sell off, and never toward the end..... that is when I have to bust out the cattle prod.

pancakes

this could be yet another morning for pancakes... except that turned the market around last time..

um...

well I'm going to risk it before I get superstitious....

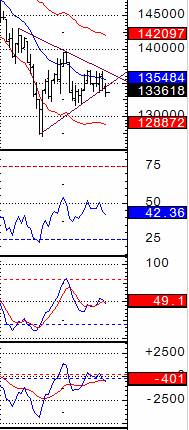

Here is the premarket.... that is yesterday's trading with the open... that blue trade channel was what I was watching yesterday.... and we are right back in it.....

NFP

nfp next week

will we be at the 12000- or 12200 waiting for the data?

On a Pass fail on NFP for that morning? Fail 11,500. Pass 12,500.

I have so many plans today

Everyone I know who works for "The man" they all want to do stuff on Fridays.... don't they work all week?.... I'm tired on Friday...

and want to pull the covers over my head and suck my thumb till about 9 am on Saturday....

I'm trying to have a mellow morning... but full trading day... then I have a full workout scheduled.. followed by more plans... probably go till midnight....24 straight hours...

.....have I mentioned

... I'd pay to have someone show up and knock me out....

every week is like a marathon....

have I shared my thesis that we will have a move to more "quality goods" over this super cycle... computers that last 5 years... TV's that last 7......

much of our "wealth" as a nation has gone into our landfills..... Time for that to end..

I'm still working on how to play my "interest rates will go up" Ideas..... If I could borrow money at current rates.... then loan it out as the rates go up....

this part of the market still Befuddles me..... what do I do... short bonds?

AIG and credit Swis? are taking losses on credit default swaps?

I'm going to lay in bed...

does today feel like a good Third wave day?

counter to that thesis is that today is when the 401K's come in a buy the market.

Thursday, February 28, 2008

I can't believe there is gambling going on around here.

.... my local paper... I don't get to read it usually till the end of the day....

Front page.... 2 stories.... first about how the local legislature is trying to limit liability for builders and developers for being sued for "problems"...

Second story.... "unusual snow melt causing problems in new housing developments".... umnnn... we always have snow melt... and we didn't have an unusual amount of snow...

every member of our local legislature is either a "Developer" "builder" or "insurer" of housing.... it's completely over built.. and they built things up like there is no tomorrow.... poorly... they have massive liability.... and yet... we have such a completely corrupt state... they will never be held liable..

fast money

I hate this show....

I don't mind hearing what they have to say... but after my long day... the last thing I want is to have 4 traders yelling at me... ok 2...

I swear Pete is Deaf..

maybe it's a trading pit thing...

Numbers....

As we go through financial stats.... and we hear "these are the same numbers as the "end" of the 2000 recession....... we have to remember that we need the numbers to hit the beginning of the 2000 recession or the 90's recession... and then move to the stats similar to the end of the recession....... not the other way around.

So..... as we hear.. these inflation number are like the 1982 numbers....

we are in the beginning of this... so we are in the early 70's numbers... and we have to move from here through the 80's inflation....

so the commodities trade is just starting.... and the bubble will be at the end..... One idea I have is that like gold doubled in the last year of the gold bubble in 1980... and it hit $800....

At the end of this commodities bubble..... I'll look for a move from say $1800 in gold to $3K.... but this is 4 years out... or so..... a Hyperbolic 5th wave move.... above the $2K range.....

If I were a General fighting the last SuperCycle.....

but know we wont' fight the old battle... this will be the new one....

Nixon devalued the dollar massively... and we won't see that kind of move.... but we will see similar accelerated inflation... With some charming Deflation......

immovable object and unopposable force

toughest money I've ever made..

I was looking at volume based on price.... and the highest volume for the past few days is at the worst places...... Bad for the Bulls..... most the money made would have been made by holding money overnight....

my crystal ball says up futures in the morning.....

This is what I'm saying....

if we make it back to 12800 we go through it.... if we make it to 12200 we go through.... and none of that is guaranteed....

Maybe... This has been a pain in the ass trading... with us roughly range bound all day.. starting down 70 going down to 140... then back to down 70 then back to down 112..... Without the down futures... we went down 30 pts....

if you missed this video Santelli had a awesome rant this morning about things...

http://www.cnbc.com/id/15840232?video=667246069

More on Bob Bennet

That was very impressive..... I'm just amazed at how dumb that was....

"What we need to do is build more houses...... in order to deal with the housing Glut.... does that make any sense? More houses where we have to many houses........"

Interesting

So... the new debate is no longer soft landing hard landing.......

but it's now evolved into ..... and it almost seems as though no one has become aware.....

The debate now is....

how hard will the hard landing be.......

much more debate on ... "unprecedented economic headwinds"

that is 10K Dow action kids....

I've tried to post a second chart of this, which shows a complicated elliot wave in green.... This chart is the downward move from yesterday to today.... the other one shows that wave 3 may have started with yesterdays aggressive sell off... and that wave 5 has ended... and now we would then break out of the blue trade channel......

I've tried to post a second chart of this, which shows a complicated elliot wave in green.... This chart is the downward move from yesterday to today.... the other one shows that wave 3 may have started with yesterdays aggressive sell off... and that wave 5 has ended... and now we would then break out of the blue trade channel......

or this one that shows that the blue channel should hold for one more new low... Then a correction out of the trade channel.... Followed by a 5 wave down move.... Then a correction... then a shorter 5 wave down move.... that would be the theory....

that is trade channeling and showing that we should move out of the channel at one point....

I tried to post the other chart for about 15 minutes..... and I just quit....

I do sometimes just type up some stream of thought.. so... opinions expressed... you just can't hold me to.....

I'm always willing to discuss stuff... and I'm so.....

I loved this.... Dennis Gartman said "i'm kind of a one foot in the door, one foot out the door kind of person"

which dennis kneal(I should figure out how to spell his name) made some snide remark about how many divorces gartman has had....

Funny how sad that guy is...... What is wrong with him, that he would turn a market opinion into a personal attack.

risk repricing

Isn't the truest statment about this "Crisis"....

That 5% isn't enough return on risking money to anyone.... in this environment....

and that till we get to 12% it's just not reasonable.....

I know you are an idiot... so if I hand you money.... I'm not giving it up till I get some return on it.

I like to hear our legislative branch

it makes me feel so fucking smart.

this isn't Parisian.... I find both sides so stupid.

republicans want to bail out the builders

dem want to bail out the home owners.

how if we let them all burn... and bail out the economy.

Jobs! rebuild the middle class... so they can buy shit.

I can't help if people are too stupid to invest and save, and decide to buy a bunch of worthless assets... we just need them to be able to waist their money... and slave away at some lousy job to buy Ipods and Big Screens...

here comes my hubris.

Bob Bennett

so... you know it's reported that some of the Watergate planning was done in his father's senate office...

also that dumb ass was the one that was blaming the "problems" in the markets on short sellers.

home builders want incentive to build 200K homes....

I would think that if there are 200k buyers... there will be 200k homes built..... it's called a market.... but somehow the builders want a free lunch.

Oh... there was a Toxic Superfund site that is the legacy of the Bennett fortune.... multi million dollar tax-payer big business Welfare for that asshole.

I always have this Doctor model for the opening

I like to imagine what a smart doctor guy is going to do......

so market looks good... he decides to speculate that we are going to break out of the trading range... so calls his broker and decides to buy.... that goes in as a market order and is executed off the open... driving the gap down up.... only to be crushed by traders.....

or.... we are going to the moon.

stop deflation WTF

ok this is the last bit of yesterday... and the premarket 137.4 on the SPY... looking like segnificant resistance.... Maybe we fade the gap to that point.....

There is a little Downside Trade channel I'll be watching, with the premarket..... If we hit the bottom of that expect a bounce... it's a little steep.

There is a little Downside Trade channel I'll be watching, with the premarket..... If we hit the bottom of that expect a bounce... it's a little steep.

Ben

So.... I'm still a fan of our fed chairman..... Let's throw out some pro's and Con's

CON:

- Inflation is High...... Way Higher than reported.

- Fed never managed to get maximum employment last cycle.

- They are having a tough time communicating...and aren't adapting as fast as one would hope.. by this I mean... they need to "Transition" to the new ways of doing things.. so as to not make it so hard on the markets.

- ... Ben Bernanke, acts like a child... sticking to the "letter of the law" and counting on the fact that following the Rules of what the mandate of the fed are.... problem is... in the Real world, we have to behave in a "spirit of the law" way... especially as a public servant... you have to do what the economy needs to do... not what the Rules say... if someone is about to get killed, and you have the power to stop it from happening, you have a moral responsibility to step out of the rules and do what is needed... not just "do your job."

PRO:

- The fed raised the rate in fall of 2006... when it was apparent that we still didn't' have a healthy economy.

- The fed waited to aggressively raise rates... and when they did they did it aggressively.... behaving in less of a Greenspan... fool in the shower... Idiot in the Tub.

- They are threatening to raise rates aggressively soon.

- This is Paul Volcker classic Aggressive fed Behavior... and I think they have every intention of getting inflation under control... I just wish they were working on real inflation.

I do believe in the deflationary effects of the housing bust, and the loss of equities value... and the loss of the "Shadow banking system".

The X factors on this is how much "De-coupling" will there be... I'm a re-coupler... but by this I mean that the effects will be globally felt... but... less that in the past...

and the deflationary effects of the death of the Shadow banking system... are... un metric-able....

Quote of the day from yesterday:

Talking Head, "what should investors do with their money?"

Kevin Ferry-Cronus investments "Take your family out to dinner."

I'm a huge Kevin ferry fan.

Now today from THE GREAT Rick Santelli. The only real reason to watch CNBC."recessions are a financial enema for a sick animal."

my favorite stat

funny when it's brought up that the top 1% pays 30% of the taxes in the country...... That will get to be fair when the people with 99% of the wealth.. pay 99% of the taxes... and not 30%.....

the poorest 1% in this country pay 70% of the taxes..... cry me a river for the wealthy......

that is called class warfare.... and realize who cry's class warfare in this country... it's the wealthy.

I also love how "tough love they are on the poor" and then when it comes paying their share.. it's all cut me some slack....

danger

Dennis Kneal just said the market was going down today......

just warning about those contrarian indicators.

I know.... we are all waiting for the paperboy update

After a near perfect delivery yesterday at the usuall 4:30-4:45.... This morning..... I checked at 4:15... and there it was... throwing the whole system off... Suddenly there I am franticly making coffee and breakfast with the paper getting cold.......

I guess it's better than the 10am from last week.... I just.... it throws me off.. but... it's all good... Except.. I have no coffee with my breakfast.... but that is good... I need to hydrate more...

I just don't get the 60 minute variations.... 30 seems reasonable.... but shit dude.. set an alarm...

inflation

It's funny.... the job of the fed is.

- Price Stability.... inflation

- maximum employment.

I'm not going to argue employment with anyone.. ......

But with hedonic inflation adjustments it's obvious we have traded computers for health insurance.. in our Big box economy.... don't tell me that you thought a "Big box" economy was sustainable...

but how can the fed argue that they achieved either of the two goals...... The Fed policies have been a miserable failure at both...

To Lament the technicals more... yesterdays low was an "inside move" so we could always go higher and hit yet another high..... so Caution.......

time for me to look longingly out my window for the paper boy... and make some breakfast.

Wednesday, February 27, 2008

This is the rally I was about to say that with us having 3 good tests of the upside resistance... and 4 of the downside... I thought we were going to break down

This is the rally I was about to say that with us having 3 good tests of the upside resistance... and 4 of the downside... I thought we were going to break down

What a great question...

What a great question...

"if we are lowering the cost of borrowing... "

"why is the interest rate going up"

I wish Cspan covered the hearings.... The last thing I want to hear is Steve Liesman interpret what is going on.... Can't CNBC wait until after the hearing... or does everyone just love the sound of their own voice... I mean ... I understand that CNBC is convinced that Steve is the greatest Economist-ex-economics education... in the world.... But I'm thinking there are some other people who have an effect... Maybe CNBC can get the Legislative branch of our government to give him his proper place as the "Econo-Meister" over our economy... he has some .... Ideas... I'd like to see him put them to work.... aparently he can stop the boom bust cycles in the economy.... Seems like a Great Theory...

securitization

isn't it obvious that the point of the securitizaion of the products was to hide the "Real" value of the loans.

so to say that investors could have done due dilligence to find out the value is a little disenjenuous....

another point these "Rallies" are just imposible .... it's a nightmaire if you did want to get long to get into them....

I honestly think there isn't much interest in being long the market... and the rallies are almost all short covering..... want to know how I know that? cause I've short covered allmost all of them.

Trading

The things I'm working on.

- I need to trade conservatively... I always feel like I should be trading. Knowing when not to trade is as important as when to make a trade... I guess that is the same thing.

- I have to stop trying to catch the top tick....

- this is new... I need to watch my charts closer....

Good Mornign

My computer is 70% and certainly trad-able today........ almost better that it was before... Nice hard drive failure to give me a clean slate.... Tabula Rasa.... Sure it's still in process....and I may only be 70% today...

As I look longingly out my window for the paperboy.....(that is kind of creepy). I'm looking for a gap fade this morning... if we can get a gap...and I think with as much bullishness, and as much optimism as there is out there... it's time for a sell off.

The market hates Ben.... since he tells it like it is... this continues to be a traders market... and probably is almost chaos re... direction or reason....

It may become the trading mantra to just go to opposite direction of the crowd... too much bearishness... count on it going up... too much bullishness we go down.

low dollar, high oil, high inflation ... good news.

Tuesday, February 26, 2008

Nice freak out day for me

I almost have this other computer fixed.

er... I have it fixed... I'm just trying to get it dialed in.

I'll Be

Let the Mellissa MOJO continue!!!!!!!!

Nice Call...

I was about to post that I smelled a sell off... and it's developing....

and frequent Reader Melissa has called it.....

I just went short Again!!!!....

To let Y'all know... Melissa was long at the right time as well... Basically Schooling me in having The Good market Mojo....

assuming the sell off continues..... Not to curse her lauding her skills.

I can't post a chart for some reason..... I'm totally off kilter..... it just shows how dependant one becomes of one's trading environment being "Steady".... and not being able to look to my left and see that screen of my indexes and looking over to see diagnostic screens..... well it just throws me off...

and other lame excuses But we just broke the 23.6 retrace... I took an additional short position.... I may cover if we can make the 50% mark...

more of my nonsense

I think if I had a dick right now... I'd start looking for opertunities to go short....

but I'm totaly out of sorts... not feeling well... messed up 2 trades in a row.... one of my main computers fucked up...

the Chart Astrology just feels wrong!... but ... WTF do I know...

maybe if we can get a 50% retracement... followed by a lower high... I'd say.... that would make sense to go short.

my mojo

Well

Ok... I may have the flu... I'm not sure what is going on but I've takes some positions against the market... trying to catch the top ticks.... which is stupid...

hoping here at 90 we turn around... BTW I took my positions at 70 on the dow... So I'm taking a beating... We will see if I bail on this....

this is stupid... that inflation is rediculous... 8%? YOY??? what was it...

This rally has no real conviction.... overall this has been short covering.... That is my read....

but..... only price pays.

and... my market reads have been suspect for 2 days... which is why I havn't been getting involved.....

but this feels like some solid distribution

great charts over with trader mike

some say 1400 retest...

not that..... i'm a wizard

but the trade channeling.... as we have learned.. you get a down violation of trend.. then an up... and then a followthrough of the down move....

I'm thinking.... and could be wrong... but we had the down move... then the upmove... cleared all the weak shorts out.... and settled out the instability with the monolines... now we can make some non news driven moves..... I'm looking for a turn... and not a continuation of the uptrend... I'll try and be conservative.. but I think the up momentum will peter out...... or already has...

those inflation numbers were tragic.... every thing is tragic.. and for us to trade to 13000 is stupid

except that Stocks do go up with inflation.... but then down with increased input costs....

I'm with Art

I think with what I'm seeing... I'm looking to bet with art Cashen(in?)... I say we hold the range...

we are or have cooked in the books the bond insureres maintaining the AAA.

Thinking about the TWM... QID... maybe SKF.

I'll be looking for that lower high.....

kirk has an assesment of buy before Uncle ben... simaler to a sell on uncle ben....

of course this has worked twice... and the third time tends to be different.

Morning

What's up this morning.....

Well I have some charts...... I'm looking for a distribution pattern developing... Maybe a 50% retracement.... new high 1378-1380.

course all that could depend on PPI.... maybe a few slightly higher highs.....

I'm not sure when I'll post the charts... things are moving slow this morning....

Monday, February 25, 2008

so

I'm just sidelined today... except that early trading loss.

I'm thinking Just lay up till things get clearer... I bet it would be a mistake to chase the up move... and no reason to speculate on this not continuing at least till tomorrow....

about this.....

about this.....

Bearish... the 3rd wave is smaller than the 1st....

Bullish... if this makes a new high... this is a 5 wave impulse BULLISH wave. and not an ABC correction..... possibly indicating a Reversal of our bearish trend..

I'm thinking the Ambac stuff is probably bullshit....... I'm 50/50 on it..... so is that Probable :(.... but the trend in my thinking about it is down :(

morning.... stuff

I have no idea how to bet this. this is feeling much weaker than one would think... my up thesis is kind of flat...

I think we are going down.... and yet.. I'm not excited to throw money at it.....

anyone think some Coffee will help?

What?

waiting for the ratings agencies to act? to announce the deal..... WTF on AMBAC???.....

now it's a split? This is getting to be some poor reporting..... They are going to wait for a downgraid to announce the "Rescue" WTF

Interesting questions?

Why isn't Morgan Stanley involved?

Why isn't there much clarity about if it's a Capital infusion to save the AAA, or if it's a Good Bank/Bad Bank... that will end up in litigation for the next 10 years?

Why would the banks support a Bad Bank solution on the CDO portion?

Newly Reported: Waiting for the Ratings agencies to Act, for the deal to happen?

They are going to wait to rescue them till the Boat Sinks? (this sounds like a downgrade rescue plan.)

It was some interesting market timing.

Interesting stuff.

BID ASK on the SKF was 107-113.

Now it's 110-111... LOL, I may toss those shares at 108 into the premarket....

Scattered thoughts

First... it's time to bet the fed Won't cut... with the specter of stagflation... wall street is ready for it....

Second... Some of the AMBAC stuff I was reading was the "Good bank/Bad bank" solution... which is not what was being reported on Friday... and bad for the banks, since the "Bad bank" is the CDO portion.... But I still stick to the idea that they will have to liquidate the Muni's.

hmmm... but I also see this playing out for 3-6 months.

Joe Kiernan just said... "Actors were once seen as one step above court jester"... Well, if he knew what he was talking about he would have said "prostitute"... but here we see another sign of how wall street perpetuates the Caste system..... Yep.. no Class war there...

There is a reason they called them the "Dark Ages"... no society, or economy will ever flourish without the "peons"... and to be honest, anyone who knows anything about economics, or economic history... From the Medici, to the French Revolution, to the obscenity of the Roaring 20's which Train-Wrecked into the depression... It's just stupid, and ignorant.

and the winner is...

I hate the oscars... they mean nothing besides being a few movies that you may want to check out.. besides the "Winners" that have fallen to obscurity....

I managed the last of the best picture nominees last night... Michael Clayton.

and .... Michael clayton was the best...

followed by; there will be blood, juno, no country, atonement.....

Other little rant from CNBC... they need to clue into the difference between the 2 mandates of the fed.... it's not Growth... it's maximum employment VS. Inflation..... Seems like a dismal failure over the past decade.

Sunday, February 24, 2008

bad TA

off the market oricle

I could use a variation on their theme and give them a 20% downside.

Nothing makes my ass twitch like Rabid bulls or rabid bears.

My local Economics

I'm not referring to my personal economics. I received my local community paper this week, I'm not sure if it's a monthly or a weekly... The usual stuff, HighSchool Plays, Mayor wants to be an Actor...... This is probably the local paper's way of outing him as gay or liberal or something. Which leads me to the fundamentals of my community.

If Republican America has a Dark Heart it's here, and I don't live in Texas. This isn't hyperbole either, it's real my state is the most republican, and my state representative is a huge developer, Local Senator is this ridiculous "if you cross a Cat with a dog.... do you get a Dat. Hates black babies.... The whole thing, the only minorities we have in my community are a couple of large black men who work for the Sheriff's department... Other than that Minorities not welcome. In fact, I don't think there are Whites of "marginal" breeding.... Probably my part-Irish ass is as "ethnic" as we get.

Front page of my local paper is about how the city government is in the "Red" and the tax revenue from our "Tax Base" is waining with the "Recession"..... I mean... There is no Recession WTF are these people talking about..... What is wrong with them, are they not listening to Kudlow!!!!!. The AssHatery continues.... they need to "Raise Taxes"....... MY GOD!!!!! do they not understand..... Do they not understand the Laffer Curve!!!!

So, there is an upcoming Council meeting... I'm tempted to go argue the fundamentals of "trickle down" economics to them.... Except I feel like this is the same sort of economic Terrorism that our "Smirking Chimp" president has done to our country... IE... I'm trying to bankrupt the economy of the republican base, and they are bankrupting the country... I'm not a big "Eye for an Eye" kind of guy..... so, I'm not likely to do it.... but I did think it was funny.

Saturday, February 23, 2008

Classic Weekend Blogging

For those of you who, don't follow the blog that much... on the weekends my brain tends to shift it's Watchful eye from the market to things more esoteric... And its 4am... I almost slept in.....

I'm about to fire up "Trading places"... cause I've seen "Wall-Street" too many times. ahhhh a celebration of the end of the commodities bull market of the 70's-80's.

WOW!!! I didn't realize... They are trading Commodities from Pennsylvania...... Wow, I thought it was New York Centric.... Was there a Pennsylvania commodities exchange??? or are they trading Nymex and CME...

Not to be manic... you know what would be a great book... "History of the markets as seen in Film"

Ooops there it is the CME....

For those of you not keeping score at home, Grodge made me feel bad(deserving) because of my attitude, and lack of appreciation for my father..... so I Hung with the old man last night. We went to wendy's for dinner and talked about Bond investment.... quick update... I have almost nothing to talk with him about.

I'm having this weird thing about the Timber and Tone of most Male to Male Speaking.... it's almost barbaric, in it's chest pounding stupidity.......

I also purchased a book about bonds... since I know less than nothing.... it's funny when I say these things.. when honestly there were all those business and investment classes.... This is the conversation I had with the person at the register..... I find this stuff weird... and Yes I know it's weird that I find it weird...

her,"Hi."

Me, "How are you?" and I smile.

"I'm well, and you?"

"Great!, You have a book for me. 'all about bonds' "

"well, you are going to have to give me your name, so I can look it up."

"Well, you are going to have to ask me for it, in order to get my name...... Eric."

(I'm mimicking/mocking her here, pointing out the passive aggressive nonsense in her statement, which wasn't a question. And could have been more simply phrased.)

She gets the book, comes back....

"Are you a member of our Book Club?"

"No. Nor would I like to be, But thank you for asking"

(Just pointing out that, I'm 2 steps ahead of her, and she doesn't realize it.... she could have generated some 'street cred' by being Petty after my earlier pettiness... and saying 'but I didn't ask.')

"That will be $20.50.".... Not to get off on an inflation discussion... but when I wasn't looking, books are $20 now!!!! I thought $12 was ridiculous.

I have a Twenty Dollar Bill... so I pull out my wallet, and the cobwebs pop out of it. Pull out my visa debit.

Her,"is it credit or debit?"

"Debit..... Oops.. run it as Credit."... I have 2 issues here, first if someone gets my pin number either through video or seeing it, and has my card number... it's a misdemeanor to use them.... if a crime at all, besides Theft. When Signing my name falsely is a Felony Fraud.... Issue 2 is... that I have no clue what my pin number is... since I don't usually use it... and am such a tight ass, and from experience... That is not a conversation you want to have with a clerk at a register, not knowing your pin number is heresy in our consumer society

Have I ever mentioned that since I was a kid I wanted to be a broker... Maybe I got the idea from trading places... or maybe it was quicksilver........ WOW!!! "QuickSilver messenger service" is a BAND from the 70's.....

Stock market movies

Keyword:

Stockbroker

Stock market

Stock market crash

Stock market crash 1929

well... that is about all the fragmented thoughts I have for a morning.

re-combobulating

I have some new market ideas.....

to start off with.... I'm not an armageddon Dow 6k person..... I actually kind of find these people to be Dow 6000 people.. projecting their 6000 lives on the market....

Remember the market is a commodity, and with inflation up goes the market... fortunately with deflation goes the market too.

This is funny, Not to be an ass.... but the last 2 weeks have been the worst this year..... I only managed half the gains in during each of the past two weeks as I managed in the first month... it's just disgraceful.... What a spoiled ass I am....

I have one of those ideas.... if you were involved in the deal with ambac and mbia... and if there is a chance of some kind of deal... and the market decides to break down... Why not leak it to stop your stock from falling, regardless of the "reality of it"...... and to be honest all this does is delay the inevitable decline...

I have ideas about a new trade channel and how to trade this market.. for the impending future.

Friday, February 22, 2008

quick story...

So... market looks ready to die... have have some stops set... and I have a follow stop set... and I have a limit sell set...(something greedy)

So..... I hear gasperino has some solution. or something.....

I market sell some.

I sit.... head scratch I tighten all the stops.

He starts talking...

at some point about half my tickers go blank and give me strange data....

I spin in my chair my follow stop gets hit... then I scratch my head....

This is going to cascade into an unstoppable short covering rally... regardless of the truth of this news....

this was exactly the "bullshit solution" I feared..... I was glad the market was open... in the futures I would have paid dearly with my unrealized gains.

I scratched my head for about 5 seconds.... and I duped everything... except my longs which even in the sell off were just fine.....( I own about 4 stocks emerging markets materials.... Agriculture.)

umn.....

what has to happen is we have to sucker the morons into this rally.... then sell it...

The reason for my bearishness is that there are some crushing deflationary pressures we haven't "Cooked in"

a capital infusion of the bond insurers... makes the market worth every bit of 12500.

it's tough to see the level of this market being what it was a year ago or 8 months ago.... There is some nasty shit going on.

FUCKING D-Fence Wins the GAME

Wholy shit.... do you know how much money just tried to roll out of my account...

Good win vs.. bad loss.

great win would have been to cover all of it earlyer...

I want to puke..

Exacly what I was worried about....

it will resolve as bullshit, and cost the banks even more...... but the market won't figure that out till next week...

that was exactly my fear

That is a cascading short covering rally...

and it hit every stop I had.

100% cash.....

This will be compleate bullshit... and we will be right back at it....

but only price pays

there is no way to go long

nightmare to be this nimble.

setting some stopps

We arn't as weak into the close As I expected... I'm starting to set some stops. I expect to be 20% cash by the close.

so... where are we?

I had a chance to read through and goof off most of this trading day....

I'm surprised the market didn't' reverse itself....

umn.....

when we test the lows.... I know the target I have is 124 SPY.... umnnnn I have a hard time believing it myself...

and so when we hit the lows... what is the Theory? we have to hit it 3 times to break through....

so.. I haven't looked at it but what is it 11500 or 12000? umn... I bet we get there today for the first retest... but not 11500 but 12000 roughly or we settle just short of it.

it's hard to not cover significant cash at that point..... I know 124 on the spy is the target... but we should see one hell of a fight from 12000-11000... it's hard to recommend that fight to anyone.... and some of it is news dependant...

Worse is we are going to see a "Rescue" of the insurers... which will be false... I'm not sure how it will play but ... the "Rescues" I hear are bearish for the banks. but also bearish for financial Armageddon.

my advice to traders is try and be nimble through 12000 .... and sort of prep for it.... There will Be Chop...

Elliot wave, you can look at yesterday being wave 1... and today wave 3.... retest wave 4? maybe... then a wave 5 violation of the low.

but I wouldn't' doubt we will get a bump next Thursday and Friday and maybe Monday.... just to dump stock off on the Fund folks....

flu

apparently "first on cnbc" flu is pervasive.... umn.... is that umn.... news.. Or is there more flu than normal...

I didn't get a flu shot..

but I also don't interact with the public... much

not that I'm an elitist... people don't like me.... that or I don't like them... it's hard to tell the difference.

there goes the rest of my cash... but... be safe.. I'm a stupid gambler.. wait for better breakdowns...

there goes the rest of my cash... but... be safe.. I'm a stupid gambler.. wait for better breakdowns...

Poor 4th wave action means add to position...

Poor 4th wave action means add to position... I've set some stops I'm comfortable with....

I've set some stops I'm comfortable with....