I read through my blog today......

You have to understand... I have to make money... I had stock to sell today, when we didn't have much follow through on that strong opening.... My day was full, especially when I did share some intraday charting with you....

So, I miss some spelling/Typos. I miss a ton of commas. Many broken sentences.

I absolutely hoped that today would be bullish... and we did make a new high.... it's just we should have had some follow through, and we failed.... it looks like the bears are taking new control of the market. One can say that we were up 40 pts on the dow, but when you realise on the open we were 140 up, so we closed 100 pts off the open.... 100 pts is a good start to a 400 pt elliot wave down.

maybe I'll get caught....

but we should have seen some follow through, especially on the last day of the month.

and a few weeks of swing trading after that long drop, felt right.

Uncle Ben.....

So...

if the jobs numbers are low,

that won't change trading, because they will say, "oh the fed will cut a full point, or a half point.",

If the jobs numbers are strong(or in that shitty 100K range, we call strong), that will be bearish, because besides .25 rate cut, on "credit market freeze", they don't have anything to hang their hat on for a cut. and the Governors were split.... We need Bad Consumer or Bad jobs to justify anything more than .25 at the fed funds window...

and it will be make or break point on the fed day. I'm a huge fan of having powder dry on fed day. It's very hard to guess what they will do, or the reaction to it.... but at this point there is a full point cooked into the books.(High Expectations)

(I haven't combed through Uncle Ben's speech, but I don't find it as Bullish for a cut as we, seem to be making it out to be.) But the bears, want to cook as much into the books as they can right now so we can move down in an orderly fashion.

Christmas Rally: This is a yearly Cyclical Trade... and Foolish to count on, since we arn't trading in the yearly cyclical fashion... This yearly trade starts nov 1, and moves till nov 30... Then either keeps running or flattens till Xmas-Jan.(this has been the Xmas Rally)

This is what makes today a low risk entry point for a swing trade. As week as the upside is.. we won't see more than 100 pts in upside if I'm wrong.... But if I'm right.... 200-300+pts of downside.

Low risk entry point=$$$$

Sure I should have waited to confirm a lower high and a lower low on all indexes... it was poor discipline, but i've been fairly right for months... and it was time for a little riskier play.

Also in a 3-5 day swing trade, we are in the 5th day roughly of the up move(roughly), and on the up move I was 2 days late on perfect timing, So waiting one day, could have me one day behind the curve.

Honestly, Like a fool I'm pulling from the august correction play book(but I can count a lot of people will do that, with some adjustments for an easy fed), with a 1970's bear market Model(You can't trade like the 2000 recession, because September 11th messed up the trading.). and 1990 doesn't quite show the magnitude of this event.

The point of my blog is to share my trader sentiment, as Y'all do with me. Since I'm isolated from the "Wall Street" bubble, blogs are how I measure sentiment(Besides that Fucking CNBC).

I'm often wrong, and won't be surprised If I have made a mistake.

Financial history doesn't repeat itself, but it often rhymes. You can't be stupid enough to trade off anything I say.... I'm lucky they let me out of the straight-jacket long enough to trade.

J. P. Morgan

Friday, November 30, 2007

Apologies again

Update

When I saw Tech weak, the R2k Weak, materials start strong then get weak..... I Umnnn

decided to swing trade...

I also have some ideas about Kudlow trying to Troll the shorts out of the market.... maybe even at the Behest of the man he met with this week, on Pennsylvania Avenue. They know the fed is short Bullits and are pulling out the stops to Hype up the market.

So I went short...

I'm not superstitious, but if I name specific trades, then I get embarrassed if the trade goes bad, and then My ego gets involved.... besides some ideas about my trades.... I'm not big on giving specifics...

It's Friday, time to have a weekend... I'm sure I'll update later.

Look at this

In the red.

RIMM -6.2%

BRCM -1.97%

SNDK - 1.81%

INTC - 1.67%

AAPL - 1.14%

Java .2%

AV 0%

ADCT 3.23%

(ah... Telco and solar are up)

People are seriously rolling out of tech and into Financials.....

They should be rolling out of retail..... and Wait... That is how to do it, take your profits in the best and move into what was the worst.

Next move will be out of materials and into Consumer?

Morning trade winds

Obviously people are selling oil and gold and bonds and moving into equities.

If the fed is going to cut rates the dollar should move significantly..... Except... Europeans are moving from Euro's into equities... keeping a bid in for the dollar...

The Russell 2k is up 1.2%, the NASDAQ is up .5% , Dow is up .8%, and the S&P .9%.

Alot of that has to be short covering....

Basic materials up 1.7%

Capital Goods 1.5%(industrial)

(to me this says Inflation/Stagflation is the Current Bet)

2.3% in financials

(bottom picking)

1.9% Transportation....WTF is that about???

TBSI

EXM

DRYS

GNK

(international Freight)

Force protection is down big... apparently that is about the marines wanting a different vehicle.

Well.... overall for such a strong open the market is looking flat.... This just felt manic.

Regional banks are killing it again. Technology???? the weakest thing in the day??? People moving out of it, and into other things???

My morning stats check

Yep... I'm a little late with this.

Overnight Libor 4.694, down from 4.75 or so.

3 month libor, Up again 5.131 from 5.129(or so(I didn't write this down yesterday))

The Great and Secret Peso(USDollar).

1.475

in the short term we are in an upswing against the euro(the dollar is falling)... Based on the promise weeks ago of no new fed cut, the dollar stabilized in the 1.46 range. Then moved into the 1.48-1.49 range on the rumor of another rate cut, and made some new lows. Then as those rumors were unfounded it moved back to 1.47.... Now with the New fed cut theory.... It is.... working it's way back to some all time lows....

Regardless of what the great and powerful OZ says(Kudlow).

Here comes the Storm

I've said it before, I like Kudlow...

Then fund a small Welfare system so that the Peons can get enough food, to keep them and their dirty kids enough food to keep them Grinding away at the grist mill or our Great Economy, and they can have the Chaff.

"hey son... if you just push harder, you will get ahead young man."

*grind grind grind*

"but Sir, I'm bleeding, and I've developed this terrible

Cough."*Hack Hack*

"let me get you some cough drops, and a dirty rag to cover up those

wounds, but don't stop pushing.... Christmas is coming, you don't want to

disappoint your kids do you?"

At least you know where you stand.

But Behind the Great and powerful Oz...

I think, he knows we have an Epic Recession

He knows Rate cuts will destroy the dollar.

He knows gold is going to the early to mid Teens.

Oil will go to the $120-$150

Gas will go to the $4-$5

The Consumer will be destroyed

But, The Financial system will be maintained.

and The Wealthy that, in his opinion "Drive the Economy", will be protected

and their equities will go to Infinity... Only fools with Cash will be

burned.

He will give a hart felt apology, when huge parts of the economy

Burn.

"Sorry, it's awful when people get hurt.... but sometimes to make an

omelet you have to break some eggs.", He'll say.He says that the dollar has stabilized.. but that won't last long.

Well Gentleman....... Place your bets...... Place your bets.......

Where she stops, No body knows.

I don't think I would be In U.S. dollars, Equities, commodities, or foreign currencies.

Disclosure, long equities... soon to be out of cash. Dow is going to infinity.

Don't worry, we will get those Freeloaders off their land soon.

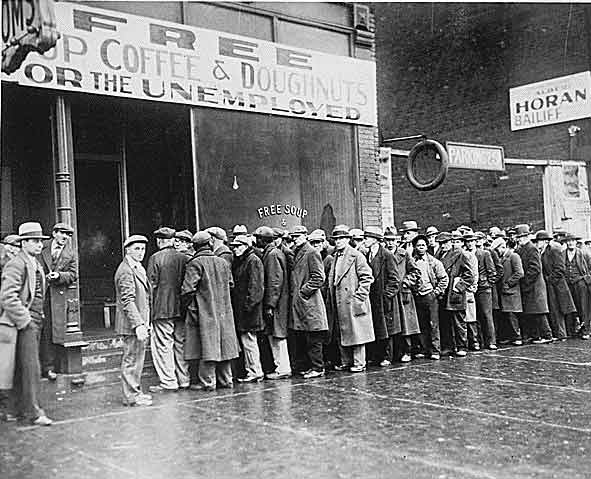

It's obviously not the banks, who are the freeloaders, it's these speculators on their farms in Oklahoma......sorry, I was just having a flight of fancy to another time.

Thursday, November 29, 2007

What in the hell, has you so worked up Eric?

I wish I was asleep, but I'm not sure I can... I may as well blog this.

If I didn't suck at posting these charts, Forcing you to download it and zoom in.(What can you expect from me, Seriously I have no adds.... and to be honest... Totally honest I don't yet value you as a reader yet, To put that kind of energy into it...... I'm very sorry.

You would find out that this chart is; Gold, Euro, and the S&P 500, indexed.

- The S&P is up 3.5% (The S&P is inflation adjusted... so if mainline is 2.5% your up less than you would be up 1%, using mainline inflation)

- The Euro is up 13%(and is not inflation adjusted, ECB inflation is 2-2.5%, so if you "invested" in euros, your up 10.5%)

- gold is up 25.5%(it is inflation adjusted, but there is speculation in it.(there could be speculation in the euro, but that market is so large, there is no more than 2% speculation.)

Ok, so where are we:

In august inflation was roughly 4.5%-8%. The the fed, and it's Printing Press stepped in, and Like magic......

By October inflation was 10-16%. Doubling your inflation with a .5% cut.

After another .25 and another month it's 13.5%-25%(remember the Euro is not inflation adjusted for mainline European inflation.)

Beginning in November, with the promise that the fed was done, we have only seen +/- 1-2% inflation(which is standard inflation by my calculations).

Now to Draw some conclusions....

I believe in standard 7-12% inflation every year... Sorry, it just seems to me like everything is twice as expensive every decade:

1980 a candy bar was a .25,

1990 - .50,

2000 - $1,

2007 - 1.50(Sure it's a bigger candy bar, but if a computer can get faster and

be deflationary, a candy bar can get bigger to feed people with larger BMR.)

So... With standard 9% inflation for 11 months of the year. and what I calculate as 15.5-20.5% Inflation(I pull 5% off of gold to account for speculation)... Those nice .75 rate cuts Cost 6%-11% Inflation.

Now.... Look at that cutting from 5.25-4.5 is a 16% cut(roughly), and the "NEEDED" cut to 3% Fed funds rate is a 33% cut

Solution= if a 16% cut caused and increase of 8% inflation(totaling 18%), Which means somewhere between 40-60% inflation next year.... and that is if they don't cut another .75... to 2.25

What is that 14-30% against the euro (1.70-1.92)

and will it handle that without collapsing.

honestly there are additional variables, like exported inflation, Easing by the ECB....

But also things like, decisions to decoupling from oil, and asia.

It's great, We save Citibank from marking down their assets fifty cents on the dollar, and we get all our assets cut down by .50 on the dollar.

it's times like these that I believe in a massive Cabal, to destroy the middle class.

If they were being reasonable, and holding off... I could trade my way through this... But realize I need to make 30% return on top of 30-40% inflation, that is a 70% return... I've never hit a double in a year.

I should get a job, put my money in Euro's and wait for next fall.

It un-nerved me to realize the S&P wasn't outpacing inflation in march. and it's only gotten worse. 4 percent bond return, at best 10% equities this year(if you got out at the best time).. What a turd of an economy. 5 % GDP My ASS, How about .5%.

blowing their lode

If they are going to start printing money, they best print it all, In for a penny in for a pound.....

How about a fed funds rate of 2.25%

this has me un-nerved.

It's not going to be that bad right?

Looks Like it's time for the Showdown....

I'm doubtful of all this "Fed rate cut" stuff.

We are so narcissistic, I just .... What if Europe and Asia, stop loaning us money, they may come in and buy our businesses... but loan us money????

and if we become the new Carry trade???

hmmm invest in gold? a gold miner? just hide in currencies.

2 Handle on the Euro??

More Chart-astrology

I was thinking about going short in the 1470-1480 range....

But I'm hearing some stuff that is unstettling me and making me nervous about the state of the economy Re: the dollar

hey

look at my crystal ball being wrong...little 25 pt bull today..

I love that the market is forcing people to buy this market clear up here.

cash is King

5.5% from country wide bank out of a 6 month CD....

it's interesting that they would adverstise for it on CNBC, as most watchers think there is a 25% chance they become illiquid.(hmmm is that a good way to put it?)

Nice... Banks

Sweet, some new bank pain... fortunatly they arn't trading with the market... at least the regional ones.

my prediction for the day is down 160-210

My theory on the regional bank was that hopefully it was the first bull market in this bear market...

Cramer*rolles eyes* says financials, materials and industrials, and hand held tech. are bulls.

I absolulty disagree about the "Money center" banks... those huge banks are skrewed.

Wednesday, November 28, 2007

Trader talk. Steve Liesman said "as a trader, what you do is make your best guess a go with it."

IMHO, that is the last thing you do as a trader.

Most the time, you evaluate risk, and take the least risky bets.... "The downside is less risky than the upside." and you make your trade.

or on the short side "the upside is less risky than the downside" and you go short.

But you do every thing you can, to not guess.

and if your guessing, you keep your powder dry, and wait for a better opportunity. I have way more opportunities than I have available cash.

Luck

so, Technical analysis.....

I'm a huge Math Wiz... I guess... I was that kid who the teacher always had to hassle to write down the steps to my solution. I could just do it all in my head, step by step. I visualized then slapped down the solution. I did finally sort of throw down a step or 2 just to show some work. I also have great long term memory...

I also, am a huge believer that the world can be represented for the most part by mathematical formulas, and shapes...

People line up at the grocery store, in a bell curve, for the most part... its a herding mentality. Also The third wave of an elliot wave being the largest just shows more herd mentality, as that is when the Crowd piles into the trade. They also tend to have 6th and 7the wave finishes, which tend to account for blow off tops.

It's not that the world can be represented by numbers, but that numbers can be used to represent the world.

No Two Oranges are ever alike, therefor 2 oranges don't exist, they have different flavors sizes, weights, colors, tastes. And yet I agree 2 oranges. This always accounts for anomalous deviations from numerical models.

but if you understand that, you can see the world through funny little numbers... but always understand that there is a real world that lives and breaths under it.

So, I like to call it Chart-astrology, Regardless of the Hitting percentage of the batter, it doesn't mean they won't miss. And when Technical analysts start talking about the "Magic of 7's" or other crazy shit....

But a good chart read can give you a significant advantage.... They say you can't pick top's and bottoms... And it's true.... But someone does.... or they wouldn't happen.

So, I thank my lucky stars every great call I make, and Seriously Can't believe when I make a good one. I try not to let it come down to luck..... But regardless your rolling the dice.

ron insana

The Markets Silver Lining

check out this video

The guy makes a lot of sense overall, I'm suspect of ...

well, I think that we can push the dollar off a cliff if we aren't cautious... so cutting aggressively is not something to do lightly..

and there are only so many arrows the fed can spend...

Also I think that Citi group and all the other banks and mortgage lenders that created this mess of greedy fake commercial paper , They need to pay, and pay big, Citi needs to be split into parts, and some of the other big banks need some CEO firings, Board of director Clearings... Some people need to pay. some chapter 11 filings...

As I've mentioned... It's nasty that in this economy, you can't get a nearly guaranteed 10% return on your money...., not in bonds, stocks, real estate. That says more about where we are in our economy than any indicators...

Unbelievable painfull to be a short today

... so I buy this silly regional bank... good long term investment...

But had I purchased freddy mack I'd be up 14%... and it's a Piece of shit.

Point being, this is more short covering, than rally...

I expect some pull back tomorrow...

I doubt 300 pts,

I expect some up days till next Thursday.

I had such a good day I just don't care...

I miss the bull market... I'm coining money, but damn I'm working hard.

*knock on wood*

Morning Wed Nov 28

3 month libor

Up slightly, I'm showing 5.062 from 5.062(seems like something is wrong maybe it's 5.07)

Maybe it's tapering off

Overnight Libor

Up segnificantly to 4.768 from 4.673

The Euro/dollar and gold are looking like we arn't going into hyperinflation....yet

1.4735 euro 797.85 gold cheepest they have been in 6 days. It would be nice to see 1.465 in the euro.

The last uptick was caused by that rumor that the fed was going to emergency cut.

Tuesday, November 27, 2007

bottom picking.... the reasons I was wrong and the market is going to sell off tomorrow.

I'm just playing here.

I'm just playing here.

I wrote up this long post about how the shorter timed sell off, on the upside move, Pluss the short violent reversals, also show a change of mood in the market....

Basicly short thin upside moves turn into large faster upside moves, and deep downside moves turn into thin ones and fast upside and downside intraday moves.... show the reversal....

or what I hope is a reversal :)

So......

This was a good day for the market, the lows held and there was agressive buying below 12800. Lots of reversal calling .....

but let me warn, it's a short term rally... Maybe... or we break down and go to hell.

Bottom fishing

Non Farm Payrolls. dec 8th

FOMC meeting on the 11th

CNBC

Charming, Erin Burnett just gave her analysts view... well maybe it's CNBC's annalists view.

I think CNBC needs to figure out if they are analysts or journalists....

if they are analysts... they are some of the worst... Journalists... again some of the worst.

maybe they need to figure out which one they are.

then maybe they can do a better job.

Market

Well it feels bullish to neutral today, I'm in cash.

I say Neutral trading from

13000-12800

S&P from 1440-1400

If we hold above 1410 or 12800 by the end of the day, near term we are at a bottom. after a few days of trading then a dip down a little lower and we will have it...

That is my crystal ball...

then jobs numbers

and i HAVE NO IDEA ABOUT THE FED. or how the jobs numbers will affect it.

3 month libor 5.062 from 5.040

Overnight libor 4.679 from 4.673

dollar is at 1.4852... Which isn't in decline, the high is 1.4950

Well, personaly I'm mor the fence here...... I feel like the market is ready for another leg down, or...

Seems like maybe the market feels ok at 12900, or 1430-1440

Nice resilient futures this morning.

I'm looking at more banks this morning.

Monday, November 26, 2007

Mortgage mess

If you can find the video link on this page,

This short piece talks about what the problem is in the Financial industry..

Then we will get derivative problems. 600 Trillion in them.

grrr

1406 Ugh....

12740 DJIA

aparently nobody wants stocks.

bearish if we leg down again off the open tomorrow

Neutral if we trade neutral and just sort of sell of into the close.

12600?

12000?

I don't know.

I still can see some neutral trading, if not Cliff Jumping.

A Tail of Two Markets

"It was the best of times, it was the worst of times; it ws the age of wisdom, it was the age of foolishness; it was the epoch of belief, it was the epoch of incredulity; it was the season of Light, it was the season of Darkness; it was the spring of hope, it was the winter of despair; we had everything before us, we had nothing before us; we were all going directly to Heaven, we were all going the other way."

-- Charles Dickens "a Tale of Two Cities."

As the R2k, tries to haul us under, and the Nasdaq tries to haul us up to new highs. Which market will take us which way, will GRMN, Circut city, AAPL, HPQ, CSCO... lead us higher with their thin leadership....

Or will The R2K with it's chipoltle, vonage, etc take us to Hell.

"It is a far, far better thing that I do, than I have ever done; it is a far, far better rest that I go to than I have ever known."

-- Charles Dickens "a Tale of Two Cities."

I hate when I get poetic with the market.

Nice morning

I was suprised how strong the morning was, Now we are starting to get serious about breaking down, getting into the 1430-1415 range and the 12900-12800..

This is super defensive bear trading, after getting burned over xmas, they are super cautous. 50% retracement then cover, repeat (maybe you call it a backtracement), but if your momentum is to the downside, a little retracement would be to the upside right? but it's getting more agressive on all indexes.

I expect to see some more serious d-fence at 1420 and 12800... but the dow is the strongest right now.

5.040 increase to the 3 month libor.

4.673 slight increase to overnight libor

This ain't over till that number stabilizes

1.4872 on the dollar down from 1.495 which is the record.

The Dollar scares the shit out of me... to be honest... I don't know if it's possible cutting rates will give it some relief, like some say, or push it off a cliff. I was looking at fed rates and the stock market, and in past times when we were in this position, we had a rate of 8% and not 4.... Foolishly I looked at the futures last night, and it keeps me up. I always want to stay up all night and watch them change. I may call today off, except there could be a ton of money to make day trading today.... I hate that shit, except in this market, it could be the only way to make money.

Sunday, November 25, 2007

In California Governor Arnold Schwarzenegger has joined with four mortgage lenders to freeze adjustable interest rates (ARMs) for some of the state's highest-risk borrowers; another unprecedented move. The Governor hopes to avoid a collapse of the California real estate market which has gone into a tailspin. Home sales have plummeted more than 40 per cent for the last two months. Prices have dropped sharply---roughly 12 per cent statewide. New construction has slowed to a crawl. Layoffs are steadily rising. Jumbo loans (mortgages over $417,000) have been put on the "Endangered Species" list. Even qualified borrowers can't get mortgages. Nothing is selling. California housing is "off the cliff".

Paulson:

"The nature of the problem will be significantly bigger next year because 2006 [mortgages] had lower underwriting standards, no amortization, and no down payments....We're never going to be able to process the number of workouts and modifications (to mortgages) that are going to be necessary doing it just sort of one-off. I've talked to enough people now to know that there's no way that's going to work."

Nouriel Roubini. Stern School of Business

"It is increasingly clear by now that a severe U.S. recession is inevitable in next few months...I now see the risk of a severe and worsening liquidity and credit crunch leading to a generalized meltdown of the financial system of a severity and magnitude like we have never observed before. In this extreme scenario whose likelihood is increasing we could see a generalized run on some banks; and runs on a couple of weaker (non-bank) broker dealers that may go bankrupt with severe and systemic ripple effects on a mass of highly leveraged derivative instruments that will lead to a seizure of the derivatives markets... massive losses on money market funds with a run on both those sponsored by banks and those not sponsored by banks; ..ever growing defaults and losses ($500 billion plus) in subprime, near prime and prime mortgages with severe knock-on effect on the RMBS and CDOs market; massive losses in consumer credit (auto loans, credit cards); severe problems and losses in commercial real estate...; the drying up of liquidity and credit in a variety of asset backed securities putting the entire model of securitization at risk; runs on hedge funds and other financial institutions that do not have access to the Fed's lender of last resort support; a sharp increase in corporate defaults and credit spreads; and a massive process of re-intermediation into the banking system of activities that were until now altogether securitized."

(Nouriel Roubini's Global EconoMonitor)

Ouch

WE have to consider the possibility that the housing price downturn will eventually be as big as that of the last truly big decline, from 1925 to 1933, when prices fell by a total of 30 percent.

From arizona republic

All segments of the Valley's housing market have been hurt by falling home prices and rising interest rates and payments on adjustable-rate and subprime mortgages. But the problems are worse for homes in the $400,000-to-$450,000 range because many speculators bought in those neighborhoods, some families moved up beyond their means, and the recent credit crunch has made getting mortgages for more than $400,000 tougher. . . .![[Japan-Land-Prices-Update-2007-11-RGB-176-10-10.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgZjNGdVpFaU89pC_jmi1DgESq0XfMJBDYVkX2Rdu7tUZQSmopyk1032mojzS6Q9dOuqwB3B84NkJ7Ksm50u0h-dR5nQ3H8j3MczHYeng7-ipoGSZYt0nBcdqZGH8F2ITaaVlhU2ZakkEnf/s1600/Japan-Land-Prices-Update-2007-11-RGB-176-10-10.png)

Saturday, November 24, 2007

Black Friday

Pricegrabber.com top lists of Xmas Consumerisum.

1. Nintendo Wii Console

2. Microsoft Zune 30GB Media Player - Brown

3. TomTom ONE 3rd Edition GPS

4. Activision Guitar Hero III Legends of Rock Bundle

5. Canon PowerShot SD1000 Silver Digital Camera

6. Microsoft Office 2004 Student and Teacher

7. Western Digital My Book Essential Edition External 500GB Hard Drive

8. Magellan Maestro 3100 GPS

9. Canon PowerShot SD750 Digital Camera

10. Canon EOS Regel XTi Black SLR Digital Camera

Top-Selling Product Categories on Black Friday

2007 Top Product Categories 2006 Top Product Categories

1. Plasma & LCD TVs 1. Digital Cameras

2. Digital Cameras 2. Plasma & LCD TVs

3. GPS Navigation Systems 3. MP3 Players

4. Toys 4. Toys

5. MP3 Players 5. Laptops

6. Laptops 6. Women's Handbags

7. Wii 7. GPS Navigation Systems

8. Shoes 8. Fine Jewelry & Watches

9. Women's Handbags 9. Living Room Furniture

10. Computer Flash Memory 10. Xbox 360

Suprising to me? the importance of woman's handbags.

The segnificance? woman wish you would buy them a handbag... Cause it ain't men doing the searching.

I wonder if you can search by popularity.?

Friday, November 23, 2007

Muddled

... I don't usually put much stock in holiday trading, But.... It was what it was.

Honestly today was a significant change from past days short covering rallies.

Umnnnn..... If you notice the blog title, I acknowledge my willingness to buy tops and sell bottoms... Like every red blooded American.

At 1420 I wanted to short, and at 1440 I wanted to go long, this indicates that we are trading neutral.

I'm confused, and see mixed signals, Bullish R2K, Bearish nasdaq, almost neutral Dow. Oil up Dow up, which tells me that things aren't back to normal, I saw no panic.... and I'm not sure if you can count that as capitulation.

lower lows, higher highs.

Caution....

this also could be enough trading to get the people involved enough to make our next leg down....

What I'm saying, is I have no call. This is what I called for 12800 then a short bullish trend, till employment. Maybe distribution for a few days. maybe monday rally, into a falling knife.

When did I enter the Twilite Zone

There is an actual debate on CNBC about getting rid of public schools.... if you want to know one thing that we could do to actually bring America to it's Knees, it's getting rid of public schools....

Ok, Nuclear War could be worse....

I'm just trying to think about things that would do a better job of destroying our economy.

Is it just me or is CNBC filled with some of the Biggest morons on the Planet... I'm honestly trying to figure out if the production staff is dumber than the Talking heads....

First on CNBC "Dred scott; making America less competitive."

Next on CNBC "Labor Law/Consumer protection/ Occupational Safety and Health: Time to put these things back in the Closet, and get America back to work!!!!"

CNBC and NBC Universal, Imbicile T.V. One topic at a time.

oops

Day trading.... Throwing my TV money against the market....

Update:

The fed is comming up, end of the month trading....

I'm trying to think about how to bet the fed.

and employment numbers.....

I wanted to take the day off...

I'm serious fuck this... I want some time off.

11:04Eastern, lol, More trading

Have to fight back off a losing trade....

havn't had one of those for a while.

I think I may be getting Trader Fatigue.....

It could be time to cash out.

Maybe it's just all that Turkey.

ok, that is almost a turn... Bullish into bearish..... D-Fence...... Stay conservative...

My other problem is... My head is out of the game..

ok, back on top of it.....

The church of what is working now!!!...

More coffee would help...

grrr...

"The consumer only feels the difference between last time they filled their car, than the last time"

Ok, this is how a budget works....

you make 40K a year,

have 40k in credit.

you can only spend so much money,

$100 more at the pump is $100 less you have to spend.

If you charge it, long term for every $100 you charge, it's $120 less you have to spend.

Fascinating this morning... Nasdaq is weak, S&p and R2k trying ot hold.....

The pattern is this, Weak r2k, weak s&P, weak dow, weak Nasdaq. then it starts all over again.

I wonder if I cycled through, Russel, then nasdaq. into new levels.

Here is another bullish sign, we break below support levels, and we aren't breaking down....

This could be a signal of the start of near term capitulation.

Holliday

I'm so unexcited about trading today, I have traded aggressively since October, and on wed, was the first time in 2 months I've walked away from my terminal, for longer than to get some water or make lunch.. I went grocery shopping.

It's been super nice, I can't imagine being too far away from my terminal today, but I am trying to extend my Holiday.

I may sneak out to look at LCD T.V.'s

Plus 80 on the futures...

Better technicians that I, are calling for 12000 and 12500

On wed the Russel 2k didn't break down with the rest of the market, in the afternoon.

Sounds like a good day for an upside breakout. Chuckle.

Black Friday

DAMN I meant to predict the futures, and I woke up today and my predictions are about right on....

we are +65 my guess, as I remember my prediction was +55.

3 month libor up to 5.015.--- Significant uptick... may even be a blow off top.

overnight libor 4.654, again, slight uptick, but a relief from the 5% that we saw end of last week I think?

My local bank was offering CD's at auction for 5.05% for 3 month CD's... I thought that was fascinating. Desperation for cash

New low in the dollar 1.496.... overnight.... Ouch...

But it wasn't sustainable and now it is back to 1.4810... the only catalyst we are seeing is a belief that the Fed will cut rates... If the fed does not cut rates in the December meeting ... I bet we see 1.46 again... and maybe after that ... we could see another cut.... if we can get some Relief in the dollar.

Thursday, November 22, 2007

Disconnect... Real Bubbles

It's always known that wallstreet and K-street, life in isolated bubbles. Concerning themselves with miopic problems, as the big ones sneak up on them and bite them in the ass.

AMT- Tax

Tax Breaks for the Rich.

Jobless economic recovery???

Inflation-Ex-inflation.

Encouraging Service based economies, of Fudrucker/Wallmart Buisness with no bennifits. No retirement, no medical....

BUT all is great!!!

Wednesday, November 21, 2007

Elliot Waves

So.......

Elliot wave theory talks about 2 wave corrections.

We had a very steep decline to this point, we have been experiencing what one could call(have called) a pause, in the 12900-13200 range, It's roughly a thousand point correction... followed by another

that is a 12000 target.

I'm not calling it, but that is my fear. I've expected bounces, and good ones don't materialize. That 300 point run up a week ago you could talk about as the 50% move.

how about some optimisum....

That rally yesterday, looked like tight stops by unconvinced Bears, which is simaler to the ones I used that indicated a top to the market with tight stops by the bulls.

Talking about Volume, Somone said "look at the volume yesterday, there have to be some buyers in there", then the same trader talked about how they had traded 6 times during the day.

To get more disenjenuous, flirting with that 12800 level, the 12600, 12400 I've started looking at these levels.

Bears eat again

Futures are down 110

I heard a lot of bottom picking yesterday, but not with a lot of backing...

stuff like "the bears have eaten well"

and "some of the market leadership is looking good."

I suspect some distribution between 13000 and 12800.

My mind is moving to Turkey day, as I'm mind full of all the things to do this weekend.

it would be interesting to see some neutral trading, maybe even a new low, then some back fill... and put the market to bed.

Why would we just test the august lows.... if you think about it, we went into 3 months of denial... That is all we have bled off... 3 months of denial. Now we realize we have a problem, and it's bigger than we expected... Testing march...

I think we will pause here.

they never talk to santelli anymore about the fed rate predictions, because he just says...

"it's a flight to safety... Regardless of the cost."

and CNBC wants to speculate on a rate cut, To save the market, like children.

This is the kind of denial in the market, that starts to make me think about a crash.

Overnight Libor, good news is it was down yesterday, but flat today...

3 month libor up to 5% but it has stopped accelerating to the upside. But they aren't worried about loaning money over thanksgiving.

1.4850 is the new overnight low for the Peso er dollar. I would call another top... but that worked out so well the last time. This new low is speculation that the fed has to cut... and they may.

and even I am getting a little neutral on if they will or should or cant. My original call is that the ECB has to cut first.

Does CNBC get tired of constantly calling bottoms in things

Tuesday, November 20, 2007

the next shoe

I'm not sure if the next shoe will be the dollar off a cliff

or Derivitives.

I saw CNBC look at this, I was stund.... they have come so far.

Sure Doug Kass talked about this.... But once CNBC starts to get it......

The Jist of this is that the CDO's were marked AAA because of the insurance... They ranked BBB to AAA because of insurance. if the insurers can't insure them.... it means

More bank write downs. and more dumping of non AAA debt....

I honestly don't know how far down the well this goes.... because I have no idea of the amount of this stuff that is out there...

Some say 100-200 Trillion.

I really don't know.

My O'l Man

So, my father has talked about doing some trading. and he comes up with the worst stocks. He wants to trade a 3 month 10% change in some crappy stocks going to 0.

So, I put him in a trade yesterday, and we get the rally this morning. I call him up....

him,"hello"

Me, "ok, we have a rally get out at... "what is a $150 gain in a $3000 investmetn.

him "umn... no... I want to make $200, oh, wait... $250."

Me, "This rally will fail, at best we still have 30% to go.".

Him " I just want to make more."

Me, "Sure, the market will bend to your will, because you want it to go up it will. I would absolutly hate for you to stop your loser streak in the stock market, Defiantly It's going to infinity"(so, I'm hard on my dad, but I wanted him out.)

him, "well how about ....(+200)"

me, "Whatever, let me know how it works out. Nothing will teach you like losing money"

Well, now he is down $50.....

I almost logged onto his account and got him out of the trade...

Long term he will be fine. unless the market crashes. which it wont.

Wow.....

This is just amazing.... This is the big move in the market IMHO, and my bet is today is the first half.......

I don't realy know... This just feels like half of fear.

Credit Crunch

If you do a search of Credit Crunch, in periodicles.... it fortells Tragic things in financial markets. When bankers won't loan to bankers.......

But... I'm so tempted by banks right now.

Because I'm manic,

cause I just called that market topping out. I'm wrong a lot, and this market could turn around any time...

I mean maybe we get into a spirit of Christmas or something.

Carl quintinilla, said somethign great today. on the rumor of an emergency rate cut, he said " Ya, and emergency cut to raise them."

And Now that CNBC has that Dennis guy being pollyanna... Steve Liesman said something super smart.

As Rick said "Why would the Fed send out an ambulance, without an accident"

Steve said "cause there is going to be an accident."

I don't want Steve to be pollyanna anymore, I like his new roll.

Looks like we are starting to develope some support at 13000.

Feels like maybe when we find a bottom we could want to be here.

We could easily muddle till the fed notes.

update on banks

cfr is up

cbsh up... The

the rest have blead back down

lead by

cnb

hban.

I think this rally has run out of steam.

regional banks up in the morning

tcb

cbsh

early winners

everything is up but cnb

Now in order

cbsh

rf

tcb

bbt

hban

kb

cfr

fhn

Regions Financial

Regions Financial Corporation (Regions) is a financial holding company headquartered in Birmingham, Alabama, which operates throughout the South, Midwest and Texas. The Company’s operations consist of banking, brokerage and investment services, mortgage banking, insurance brokerage, credit life insurance, leasing, commercial accounts receivable factoring and specialty financing. Regions conducts its banking operations through Regions Bank, an Alabama chartered commercial bank that is a member of the Federal Reserve System. As of December 31, 2006, it operated approximately 2,000 full service banking offices in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, Texas and Virginia. In November 2006, Regions and AmSouth Bancorporation (AmSouth) completed a merger of the two companies. AmSouth was a bank holding company headquartered in Birmingham, Alabama.

Pro

Texas, much of the developing/developed south. Centered in tennesee.

Third largest regional bank behind wells fargo and bb&T

Claim very limited sub prime

some exposure to alt A.

Claim No ABP(asset backed paper)

Con

Florida exposure, Lots of mississippy

Interesting thought

I just heard Joe and Carl argue about the dollar and the Yen fighting neck and neck... for being the Peso....

In 5-10 years will we be talking about how for 30 years the U.S. and Japan Lead the way into the 21st century...... And now the U.S. like japan is lagging.

Morning Data check

My libor source is down...

anyone with a good source for overnight and 3 month libor... Let me know

Look at the Peso/Dollar taking a beating

From 1.465 to 1.479.... and falling

it shows how the dollar could fall off a cliff.

I think the rest of the world is convinced that the fed has to cut rates to protect equities....

My opinion is that.... The only thing the fed will do, is make sure that liquidity is maintained in an emergency.... This craziness, is going to take a beating.

The idea that the fed has to protect your portfolio, is silly. Childish to be honest.

Doesn't' mean they wont' do it

I get a little Zen like in the morning.

I may even get some Yoga going..... I wish I had some yogurt... I digress.

One of the reasons I don't enjoy the advice of Pete Negerian, and options monster. Is because it is the essence of "Chasing the trade"

I don't mind buying something already going up, but the idea of chasing what happened yesterday, is a good way to lose money. And something I don't want to re-enforce in my trading

Which is why I'm looking at financials, they are good for a great tradable Pop. like 5-10%

Of course look at the futures.... I may have missed my pop. I did buy a materials name yesterday. Which I bet I get a 10% pop out of today.

Monday, November 19, 2007

Reginal banks

20 day performance

CFR +2.2%

CBSH -.5%

pnc -.96

BBT -7%

kb -10%

rf -11.5%

CNB -15%

HBAN -17%

fhn-20%

TCB -24%

In my looking through these there are some sucker bets (florida, and michigain banks) and some good ones, (Southern banks, tennesee banks, texas banks... Also a korean bank)

Looking at the charts

Bullish

CFR

PNC

cbsh

bbt

Bearish/Neutral

KB

RF- this does look interesting.....

Super bearish

HBN

FHN

CNB

TCB

So, I'm kind of scared... it's not like I'm not all in cash, which is a great place to be. But there is no support in this market.

I feel like a kid spitting down a well, listening for a bottom.

Just looking at it, I still like 12800, but just for a bounce, this feels like 12400 or 12000.

I may try a suicide bottom pick of a financial.

Best performing Regional banks

CFR -1.35%

BBT -1.75%

RF -2.26%

CBSH -2.38%

(this is just the kind of crazy move that loses me money every time.)

time to do some research

Late morning rally

Is it evil that I'm rooting for dow 12800, but not yet?

The Russle which lead us down here is still looking strong, the nasdaq is looking solid... I wish I had shorted it when it was at 0 today

getting back into some volitility.

Wet Noodle

Have I mentiond that this is like getting hit with a wet noodle....

I'm looking for some volitile moves that will resolve it.

So, a move under 12050, Huge Bounce... Then next leg down.

Morning

We are range bound, I think we need a move below 13050 to 13000, to then create a move to 13250, then to take us to 12800.. or lower.

This looks weaker than I expected.

but some good news would help, to take us lower. I may take a short position at 12200 if we can get back there.

Wrote this to Barry and "The Big Picture" today

Posted this to "If the us has a recession, who is to blame?"

What are you talking about ?

Obviously it's all the protectionist talk by the Democrats, and the 1 year of the "Do nothing Congress"... Don't you watch Kudlow?

and it has nothing to do with the 6 years of congress that showed up for 1.5 days a week, and the Massive deficits, and lack of substantial economy.

If Only we could Lower Taxes on the top 15% of the Economy to 0, then we would see some progress in this economy. And the Uber Wealthy could Lord over us like masters of the universe shackling middle America to the Yolk that they were born to... umn...Er... "Provided the Stable Economic base" to create the Greatest Goldylocks economy Ever.(that was super fun to write)

Don't you watch the news? this has been spun already.

But... Honestly. It's our overspending... our fat American lifestyle, and the deficit...Caused by the war, which we, as Americans supported.

Like most things, we have no one to blame but ourselves...

But definitely political Hay will be made of it, as a side-show(on both sides) and it will make it even more difficult to come up with solutions.

Hurray for democracy!!!

And Recessions are inevitable.

Listen to the Black helicopter crowed and it's the Fiat Dollar, and the International bankers.

I thought it was funny, and I'm a Commie... No one does Capitalisum, better than a commie.

Saturday, November 17, 2007

bond, gold, black helicopters.

There are lots of bears out there. Bond Bears, Gold Bears.

So the Currency Bears Well, I can't explain it. But they want a gold or silver backed dollar..

So, this place makes liberty dollars. that are backed by gold silver and copper

http://www.libertydollar.org/

The fed raided them.

The Commodity based currency people have a point, then it all gets perverted.

Weekends

I try not to think about the market/economics on the weekend, besides reading the paper. I'm always curious what my local paper, and the other papers are saying on the weekend, since it gives me an idea what "Joe Public" will do on monday.

Funny My local paper went from "Housing Boom", "Housing Market still Great here". To... "What happened to housing?" in 2 weeks.

It's wierd how I don't seem to be that direct with the blog. Umnnn.

Interest Rates

If the fed cuts rates, there is a possiblity the Dollar will Collapse... As much as the Dollar could Collapse, but maybe 5-8% in a week. So, the Fed is on hold, They say stuff like "we are conserned about Mainline Inflation, But to me it's more about pushing the dollar off a Cliff.

What we need is the ECB(european central bank), to cut rates, that will be the precoursor to an ability for the fed to start cutting rates again... But realize we are at 4.50.. how far can they take it?

if you ask my opinion we will see 2.5% by next Xmas. But not till the ECB cuts rates, and we start seeing sines of weakening global economy.

I think we will see some cutting in the spring.

It's not the Reserves job to protect the banks or the market, their job is to protect Dollar Holders, both from depressions, and from collapsed dollar.

Friday, November 16, 2007

hey

So, I have been getting some empirical data of lay offs. I got some a week ago, then some more this week. I thought the stuff a week ago was maybe an Outlier, but this other set of lay offs just confirms a pattern.. for what my empirical data shows...

This stuff won't show up till December employment. If that.

I thought it was worth mentioning.

How bad was my compass today

I guess I can't win them all. I do think that even the Bears are tired. I know I am. I've made good money in the past 2 weeks..

A day like today , where the technicals say we are going lower.

Maybe not today but in the future. My impulse would be to chase the short, then we would rally for a few days "sort of" and then we go lower...

I still say a rally to my target or close.... But a day or 2 of distribution "and short distribution here" and a short covering rally, as the bad shorts cover and run in a small rally....

I do think there is a chance we test the august lows. or 1420 on the S&P... I think that is 12600 or so on the Dow. The Russell 2 k sucked it up big time today... Ugly...

I'm also psyched to start trading the long side. I make much more money that way, it's hard to guess what the beaten down secters will be, or which stocks will take a hit.

It's been an epic couple weeks ... it won't surprise me if we test 13000 on the Dow... I'm still hoping for my rally. but Monday or Tuesday.

It will do me good to be in cash for a few days, i'm getting tired.....

Danger

Bulls have yet to take control........

Comon boys, you can do it... I want to get short again higher.

I'll stick to my theory.. but I would have expected the bulls to have taken control by now.

9:50

Dumb asses... pricing in the fact that the fed won't ease... Like it helped weeks ago.

I hate this..... I don't want to play today.

10:15 Failure in the DJI and the QQQ.... Looking bad for the iwm

1440 in the S&P and 13050 on the dow... What to watch.

This smells like capitulation... I hate chasing this stuff.

I want to workout... Comon bulls.....

Day Off....

I'll look at the up velocity of the morning move, but... I may go golf.. Honestly I'll run or ride my bike for a few hours.

I have had some huge wins over the past weeks, I need some rest... I also don't know what to buy on the new dip.

Look at JNJ vs the SPY.

Hey look T Boone just purchased my shopping list.

early morning speculation

Ok... I say bounce to 147.2-148 on the SPY today. Then I bet on a monday move Range bound in the 146.4-144.7........ Followed by.... Capitulation to the 143.4 or lower.

My Thesis on the capitulation is that the longs are going to get tired of the pummeling, They already are starting to get exhausted.

I on the other hand will only come and play if we hit the high end... Like 148.2 ish... I'm tempted to buy a consumer name Like J&J, and ride it into the capitulation, then move into something else after that... For some trades.

I saw some debate on the commodites plays going limp.. and I'm agreeing. in a natural recession cycle that woule be a normal sector rotation.

IMHO we have cooked into the books a 3 month recession at this level. Recessions are 11-30% correction.. But that will have to happen in phases. Final capitulation happens in the middle of the recession. So 1.5 months 45 days from the highs would be the bottom of a 3 month recession.(roughly) We are 26 days in.

Bear markets are when we are below the 200 day moving average.. So... that is 148.5 right now.. I say that is the bounce.

Bearish things...

New Lower Lows yesterday in GOLD, Oil, Technology Leadership; aapl, RIMM, GOOG.

BULLISH... NO new low in SPY, DOW, and IWM.

I just think we will either test the recent lows or make new ones. overall we may settle out at 145.4. Untill we get bad employment numbers...

Or everything is fine and we go back to the highs.

Morning compass

OUCH...

Huge Uptick in Overnight Libor 4.995

It is normal for there to be a pre weekend uptick in Libor.. this was a little larger than the normal uptick, by 10-15%. Similar to what we had 2 weeks ago.

3 Month libor 4.905 another uptick to a new week and a half high in 3 month. Slightly higher than normal.

To me this is a little bit of a concern. more than last week, but better than the one before.

To me it says that the banks are more nervous about loaning money to other banks over this weekend, than last.

Gold and the Peso/Dollar.

The Euro is looking like a double top. I say it trades 1.4450-1.4625 for 3 months, if no intervention(ECB cuts, or else).

I say gold takes another leg down soon and tumbles to $750

With a stable Dollar, this means that unless the fed cuts more commodities have topped out... Included in this are oil, copper, Etc..

I'm going to pick up some deep drillers and refiners for a seasonal trade after we tumble and capitulate on oil.

Thursday, November 15, 2007

if we don't threaten the 13000 level in the dow in the last 2 hours.

I think this will be a reversal day.

Also, though things usually don't work 3 times... I think we will get a small end of the day sell off.

I still say 145.5 or so.... and then it is time to buy for a reversal

Interesting theory is the day trading bulls, arn't going to hold stock overnight... So that pluss the short sellers means sell off.

with a short covering slight rally..

I say go long at 2:40 or so.

LOL

and if you listen to me you will definatly lose money.

spy

145.50 is my downside target... and I say........... that is it....

But we are trying to break down......

Rimm has a near term low

gold broke it's near term low

Wow... Flight Delays.. how out of touch is that.

Char-astroligy

a bullish Elliot wave forming or desending triangles??

New Prediction is that this current 11:20 move resolves itself lower inverted cup and handle.

at 146.40 spy

I only do this to entertain myself.

10:48

Neutral... Cept the IWM... baby bear.

just my opinion

if you look at the indexes and not the spy and qqqq, they are slightly bullish

Neutral pluss.

ok, I have to concede that everything but the iwm is looking bullish...

Of course maybe it's yet to be bullish enough to get enough bears involved.

It's making me want to go for a run.

cept I have stuff in play

Morning Crystal ball

If we break 13050 we then go to 12800..... But expect a break of it, then we should bounce back above, then after the bears Reload we should drive down to 12800.

12800 scares me, to jump in long cause then we play with 12500

My morning prediction is we go down to 13140 Bounce back to 13200, then break 13140... bounce to 13160 then we test 13000-13050....

Dennis Kneal...

So, I think it's better we have dennis making irational bull arguments instead of Steve Liesman doing it.

Behind the Curve(dennis), Says " Short Euros"

Also Inflation doesn't mater unless you buy gold.

Also, "who cares about dollar weakness."(unless you buy something imported, I mean seriously we are an export economy... Right?, It's not like the U.S. Imports most the stuff we buy right? no one is buying toys and electronics from china.)

This was Awesome, On monday when he said "oh I'm so scared about the market, it's making me nervous." today he says. "I think you should have purchased Merril on the bottom on monday.... 2 days later... Dennis... Your 2 days behind the Curve.

BTW get me a stock chart of the past year of a stock, and I'll tell you right when to have purchased and sold..... BUT THAT IS EASY NOW, DUMB ASS.

I do like that it's not liesman trying to do it.

Pending Free-Market collapse.

I'm just kidding, Way to many men behind the curtain to keep this thing from falling down.

This GE Fund colapse... I'm looking into the idea that they had to sell some downgraided assets, and I'm curious what they sold, and what price they got for them.

I heard someone was buying "Subprime assets" yesterday, I'm curious who it was. Cause I think they purchased some from the GE fund.

Just a theory.

Morning Stats

due to yesterday's personal technical difficulites(I posted my morning technicals check to the wrong blog).

3Month Libor 4.878

which is slightly up off a low of 4.867(or so)... trending up. but between the near term high and low.

Overnight Libor is 4.774

Big up move from yesterday at 4.62(roughly)

off the lows of 4.57... Back to last weeks levels. But a standard end of the week uptick.

Gold and the Euro are Down trending(After The Euro was threatening another all time high.. I suspect a larger Down leg over the day. My prediction is that they will be range bound till Q4. With the market... But due for another test of 790 gold 1.45Euro.(I suspect a little lower.)

(I'm not sure if Uncle Ben meant it about using Mainline inflation, but he was convincing. But if the ECB cuts, I see another .25.)

Wednesday, November 14, 2007

Kudlow

Kudlow hit on exactly what I thought all day...

Big news of the day was that Uncle Ben said "NO MORE EASE"

with a target of 1%-2% in fact... the rate should go up.

2.5% core

5-6% Headline inflation.

Before= 2.5% inflation and 1.5% target= 4% Rate.

Now=2.5%-6% inflation 1.5% Target = 4%-7.5% Mean 5%

"someone tell us how a weak dollar hurts the U.S. Economy?"

Well, it's not a problem if you don't buy anything imported.... Oh.. Wait everything is imported.

Macro-Eco

If the Target bond Return is 1%-1-.5%

and if you got out of the S&P500 at 10% return.

Ok, let me get to my point.

- 2-3% inflation

- 1.5% Return on Bonds

- 0% return on Savings.

- maybe a 3-5% return on Stocks this year(with massive risk).

Why would John q public do it...

What is the point in investing in the U.S. This year.....

also if you look at headline inflation at 5%... everyone is losing.

All Risk and No Return.

What I also think is that all this 1 and 2 day volitility is going to pound people out of the market.

This could just be the B leg of a correction on a bear impulse. Or the 2nd leg of a bull impulse.

Midday elliot

My midday predictive Elliot waves......

I'm just saying this market could go anywhere....

Or elliot waves suck

Or I suck at elliot waves.

NYSE

it's a merger, if they won't mention if they are or aren't having a board meeting... it's a merger

If thane was leaving they would confirm the meeting.

My bet

Update: Look how wrong I was.

Elliot wave theory

The bump we got yesterday I've been waiting for a week. Which reiterates my "This is happening Faster and bigger than I expected.

With an expectation of the 12800 low. Sow far.

OK, Without Pictures. This was either a 3 stage pull back, or developing 5 stage impuls pulback and yesterday was the either wave 4, or a wave 1 With today a probably B Stage pull back. But the question is if it's more predictive than higher highs and lower lows...

and it just isn't. I'm going to keep looking into it.

Go bears!!!!

hell of a rally to quash.....

qid 39

(i've decided not to blog this... )

I covered with a win and am waiting to come back in.

While I'm waiting...

I did break even from last nights trade...

More waiting... I did some looking at Elliot wave Theory...

elliot wave theory.. it makes me shake my head... But.. for day trading it's kick ass...

Maybe it just gives me something to think about, so I maintain focus.

Tuesday, November 13, 2007

I'm playing with Eliot wave theory

and it's killing me...

I'm just tired again.

My chart looks like chicken scratch..

Can't figure out if this is the first day of a corrective trend or the third...

Or... first day ..

this is one strong rally... much stronger than I expected.

I'm personaly thinking that it's a bunch of horseshit.

What did someone say about bear markets? They just go nowhere. This is just back to the last thursdays highs.

Are You Kidding me?

So, the banks are dumping the Money market money into the SIV's? that is where that crappy 6% return is comming from? so, to get a break even against the CPI. You get to loan money to people who can't afford it.....

What the hell is going on... I was looking at the fact the S&P isn't even outperforming the Euro, meaning that the S&P at it's highs flat with inflation.... It's like there is no where to put money where it's safe.... let alone get a slight return....

It's like we are throwing our money away...

twm 69.47 9:41

9:43 20 cent follow stop.

This is all Mountan time BTW.

Wow Bloomburg is so dry and booring... and yet good info... they talk about the yield curve.

9:50 leard the stop, and waiting for this short term stregnth to work its way through.

69.65 limit stop

9:59 69.78 stop

Stoped out

I wasn't' paying good attention... we are looking bullish.

10:00 something....Start again 69.75.

Com on market... you just suck... The air is thin... Get the fuck down.

I'm so tired of this..... range bound crap... This is very bullish overall...

I'm convinced Near term we are going to go back to denial for a while... I should research denial... figure out how it works.. people are just bullish because they are bullish... It just works and pays emotionally.. Get another leg of pain in this and they will give up..

I mean seriously no one knows pain like bears...

Wow.. the russle and the QQQQ want to go down, and the down wants to stay up... What the hell do I care, I'm betting the russel...

I'm stopped out at my break even.... I'm up for the day... lets just see what happens for the next 20 minutes.

Stopped out

I'm just so sick of this...

My expectation is that this morning rally will fail, either in an hour or tomorrow.

but I do think this decline is decelerating and we will see a bottom this week.

I think this will be a sucker rally

Look at 13150-13170... that will be the big line of demarcation for the bears... If the bulls can push above that into the 13200 the bears may look to fight another day.

I may be in this.....

I did want to take the day off, but I'm feeling a little better. Not that I'm not a fly on shit relatively.

Futures are up

Well up futures aren't fitting into my model...

I expect either a 100 point down day(to roughly 12900) or a 300 point down day(roughly)

Up futures don't quite fit that model... but we have a full day...

The thing that sickens me, is being in the 13000-13200 range again.(or the 1465-1450 on the S&P) Look for 13050 and 1450 to act as resistance today...

But if this down leg is smaller than the last ones... I'll be getting bullish... Or less bearish technically

Kudlow did say we were in a bear market correction...

Umnnnn if we can manage to hold without losing 12800 in the next 2 days, I'd say we are forming a Near term bottom

Just one idiots opinion

I'd look for the r2k to lead us down... if we go down..

I want to take the day off....

I cycle between wanting to take my profits, and being scared to not be short the market.

Monday, November 12, 2007

Hubris (random technical blathering)

So, I umn... damn my technical analysis is spot on... sure we went up to 13160 and not 13150... And sure I didn't take a new position. But damn.

My expectations are either of 2 scenarios.

- We Leg down 300+

- Or over the next 2 or 3 days we Leg down 100 then another 100 to my 12800 target... Roughly.

While the Naz has fallen off a cliff the R2k has really been range bound, or even up slightly. But today we saw some weakness in the r2k, which lead us down in the first place. The dow did hold us up, and honestly it was Citi strangely enough... Funny how what lead us down, is now holding the market up... But once it gave, that was it today....

Just my opinion.....

I expect some strength at the 12800 level, but if we get there tomorrow... I'll cover my shorts, but wont' be psyched to go long. We could completely nose dive...

I've said it repeatedly, this sell off has been more aggressive than I'd anticipated... But the past few days have been more bullish than I have expected.

So, Looks to me like the shorts are waiting for that 3:00 buyer. Who Just got killed so many times, I'd be surprised if they aren't out of business. But now that it has worked to short the last 45 minutes or so. I'd expect that won't work tomorrow...

Things that work twice, tend to fail the third time.... People get wise. Point being, long positions will be looking to sell out earlier tomorrow.. I'm just saying, I wouldn't expect a lat day sell off tomorrow, unless we are falling off a cliff.

If we see a lower level than 12800 tomorrow... I wouldn't take a long position. but if we see 12800 day after tomorrow, I'll look to bottom pick.

The reason I say this is that we need to decelerate... I always say, the market is like a truck, it doesn't turn on a dime. I just don't see us taking this 20+day 1000 point decline and v bottoming.

Today's rally I expected to see something like it a week ago... I just think there is a chance we will test march in the next 2 weeks.... Just based on the momentum. If we test Aug in the next couple days, I'd expect a 1-2 day rally then back to march.

One could thing that today was a good day for bears, but most of them took a big hit in gold and materials, so.... it was a bad day for everyone. Gold just was ridiculous today, and still it sold off. Those are some crowded exits.

range bound

I'm very sick of being range bound in here.

I think we are preping for another leg down... but....

Maybe I'm just getting Sea-sick.

this was exactly the move I was looking for.. a run up to 13150...

then the next leg down to 12800,

I would have rather sold off my shorts and restarted one or 2 at that level....

but will we leg down?

LOL

Citi downgraded E-trade because the mortgage exposure could bankrupt them....

Well, they would know.

talk is 1 billion in write downs

but they have $450 million according to some...

Which is talk that they will mark it all the way to 0?

Interesting

today, everything that is good IMHO is down, but the shit, is up. But the market is up.... It's so interesting to me.

In a way it says that all the crap has sold off so far, it is bouncing off bottoms, and giving us an up day... while commodity stocks are down...

LOL

She is trying to sort out.... Funny, the R2k was leading us to weakness earlier, now it's helping to hold us up.....

Sigh... this market....

new low on the Nazdaq, New highs on the dow....

S&P trying to set a new low, or break below it's range...

but... we are trying to reverse

I have every belief that Erin will make us rally back...

*go Stocks Go*

The Banking Fiasco

A bear, this morning, mentioned:

The S&L was a liquidity problem, and

that this is a Credit problem.

Funny, maybe he said the opposite.

I'm interested in looking at the difference, I mean, doesn't a liquidity problem with the ABP(asset backed paper) become a credit problem?

Also, The current L3(non liquid, mark to myth) assets have to become L1(mark to market) assets on the 15th of November? or can they become L2(mark to model)?

or is it that they just have to be liquid?

The idea that Goldman has the highest percentage of L3 assets has me laughing, Maybe they get stuck without a chair?

Update: It looks to me like the fasb 157 will affect things in the 4q. I'm not sure about it affecting anything more before the 15th of november.

I did mention that some of the people holding them will have to sell them into the market when they go below AAA assets.

I may take it easy today

This is feeling toppy of the morning.... I've been very aggressive lately... this does feel like the small rally we needed to take us lower. I'm tempted to cash out and do some waiting.

Damn this is tradable....

I'm just not feeling like being aggressive today.

That is a break down, it's tradable..

My Crystal ball remains intact.

Guess what Narcissistic, Homophobe(you realise this means he is probably gay), is still blogging.

Great... I'm psyched to not read this...

As my integrity won't allow, I won't be visiting anymore....

He said he was quitting, I'm holding him to it.

what am I missing out on? bad stock tips?

Yawn

Mid-morning update

Pre market zen

Oh, libor this morning is fine.

I'll be looking for weakness in gold mining, and a start of a slide in materials... BTW IMHO materials lead this market(I'd expect a multi day move), and this could be the start of some weakness, which could be super precipitous for the market.

na ne ne ne ne ne

Bear Market?

So I'm a bear on this market for 6 months minimum.... But that doesn't mean the market won't go higher. I hear a lot of bear talk about "Bear market"

I try to be objective...

Only because market delusions about how great things are .... sometimes unstoppable for months.

Like I say, I'm frequently wrong.

Also, one can say this pull back is because of recession, Like I said weeks ago, it's more about the PEG of the market being wrong. The market should try and adjust the curve to the current PEG... but with the bank problems, that level will be a high. What is that level? I don't fucking know!!!.... How about if I do linear regression for 3 months on the spy.... 154? absolute top of this market... I'd even say 152, 154 by xmas.

The morning smell

I'm looking for weakness in oil and gold this week... and bottom picking this stuff on a good panic....

I don't want to talk about oil till it's 85 bucks... and I'm defiantly a buyer at 78, with all the recent speculations, I'm looking for crowded exits for it as a buy signal... Like down 10 bucks in a day.

But..

I may be smelling some weakness in some mining/materials names. I may pick up some mining stocks....

Double top in euro

I heard somone say this... I just looked at it...

I see what could be a double top in gold.

But not in the Euro.

I do think this will be enough to shake out weak holders...

and get the fire sale going... short term.

I don't even see a good head and shoulders in the euro... but

developing....

I say short term fire sale.

Chart-astology

13060 is 50%

13350 is 38.2%

Aug-October Fib

13550 is 50%

13150 is 61.8%

12900 is 76.4%

200SMA 13250.

Then maybe we look at 12800

I'll cover my shorts on weakness, and I'll day trade; 13250, maybe 13150. At 13350 I'll throw new cash against the market.

Futures

Looks like we are seeing some stregnth,

Our best Rally is 225

So... our recent low is 13042.... so new shorts after 13267... I'd even say 13300.

We Reap, What We Sow.

Just a fast note.

I'm a switch hitting Bull/Bear.

Over all I'm a long term investor, but in this environments, you end up being a trader.

I try and practice a "Ninjitsu" style of investing, those who don't adapt die.

I'm a huge follower of Sun Tzu.

I've read every blog posting of "The Fly", (not that it's hard, it's more like reading a daily comic book) Knowing that information is power. The last thing I'd/I'll ever do is read the "Comments of the Multitudes". My life is too short.

In closing thoughts about his blog... BTW I'm convinced he won't quit blogging, and will be back in a month. He likes the sound of his own voice too much.

I did find it funny, but for the most part, unfortunately I was laughing at him and not with him. Even when he was laughing at himself... Still I was laughing at him. I wouldn't have him for a friend. He would be lucky if I'd acknowledge his presence.

The suspicious side of me has always figures he was just some investment bank or hedge fund Troll. Trying to sucker some idiots into some very moronic bets. IIG, MVIS....HANS. Very few investment quality stocks....

I also say his IQ is no Higher than 120-130

As an Homage to his Witty(or lack there of) Vernacular....

I did give you the respect of acknowledging you.

I'll be

Lookie there +44 on the futures... and some positive motion on the peso, this is a 5 day low.

In fact if one were running a SMA the 5 day would be declining.

This advances my notion of a blow off top in the peso/ and gold.

Honestly I don't believe it but...... It's something.

Overnight We had Negative futures, and that was when the peso started coming back. My theory was that the reason for the Dollar strength was Europeans stepping into or market to "Dip Buy".

Just a theory.

Sunday, November 11, 2007

Blog update

I've added a few new page elements, including some blog fun searches at the bottom, some of the links go to adds unfortunatly.... Damn google, one would think they would be the smart guys in the room.

Nothing like an unopoosed winner in the search space, getting a little long in the tooth.

Note to all 4 readers... if that. I'm going to try and improve the way I post, which means less posting.

Hopefully I just post one idea at a time, instead of the mixed questions that jumble and confuse my mind.

I would love once I start posting, to get some comments, opinions, on the questions I bring up. They will be more on the line of "How big a problem is this", I welcome opinions, But... No flaming, opinions are important, but opinions about opinions arn't.

And just to let people know, the reason I post them is because "I Don't know", and want to dig into it.

Weekend Update

My original plan for the weekend was to find a gold mining stock and an regional bank. I've done neither, It's also normal for me to be reading all Sunday evening. I'll not be doing any of that.

I intend to catch up on this stuff at 3am. It's been a rough month and just getting my crap together emotionally, and physically. Will be a huge win. I'm super comfortable where I am.

Time to start thinking about taking some long positions... but just for a trade.

I realy have shoved my head in the sand all weekend.... Which was nice.....

Black Helicopters

Well.... They have me... In my midnight insomnia... I managed to stumble on some dark shit about the Peso/dollar Umnnn... It was grim... and now I can't sleep. I'm thinking about Euros gold and Bullets.

What if I play a video game.

In other news I hate the writers strike, the 1988 one killed my most favorite show at the time "moonlighting".. and honestly nothing was ever the same for me again.

I'm pro union... But when this one gets more coverage that the UAW.... TWF!!!

but since for the most part I don't watch TV...

Friday, November 9, 2007

I say... the 3:00 buyer wont' come in today... after getting burned 3 times... and this time the short covering happened 20 minuets ago... They could be bankrupt too.

if that buyer doesn't come in. I say the shorts crush the market in the last 40 minutes.

1:05 update if they don't' get the short covering the rally will be easier to crush...

I dont' think the shorts will ride it into the close though.... which means rally in the last 10 minutes.

1:16 Ok qid 39.59 one more time

1:24 getting burned.. hand on the button.

Follow stop from 39.21 .10

1:28 stop 39.25

1:29 follow stop .15

1:30 follow stop .20

1:31 I have to pee

1:32... i'm going to free hand it

1:45 sold 40.12

that puts me up 40 cents on the day.

Opps left some on the table... Things looked shaky and my Internet has been acting up... good to put the coin in the account.

this sell off will go into the close.. Monday I bet we open in the green if we don't.... new lows.

Interesting, we havn't seen fear, and we haven't seen capitulation... which is why I'm still riding my long term short indexes.

12:31 qid 39.50

Stop 39.50

12:35 stop 39.45 have to risk to win.... I think this rally will fail

12:36- stop 39.55

12:38 stop 39.6

12:39... I don't like the chart... I think I'll get stopped out.... we are looking bullish I'm sticking with it.. I ...

12:40 very close... not stooped out.

12:41 Stooped out... Shitty win Broke even for the day. Cept for my longer positions.

I still think besides short covering, no one will want to hold stocks through the weekend.

wow 9:09

new lows in the dow and the iwm and the qqq

Spy holding on

9:12 there goes the S&p

give it a 5 min and Ill step in

9:13 there is some defence but it didn't look strong...

Defence holds... I bet the bears get a third bite at the apple.

If I were a more aggressive trader I'd step in long for a 30 minute trade.

oooohh I'd sell here 9:17

While we have a few minutes..... let me talk about the Weimar Republic....

Ok I put in an order for going short q's at a new low... Third time is the charm

Weimar was debt based on WWI and the debt the U.S. has is not quite at that level..... BTW every time someone calls the Dollar "The Green Back" on CNBC the greenback was issued by the federal government note as opposed to the federal reserve note... and was backed by our government... as opposed to what ever the federal reserve is.... I shouldn't get to upset with dylan ratigan, I've been super impressed by his understanding of the problems in the market recently... Not bad for a Gourd Player... Huzzah!.. now if he could get a handle on the scale of the problem.