Best week since 74

Too bad that bear didn't end till 75

Financial history doesn't repeat itself, but it often rhymes. You can't be stupid enough to trade off anything I say.... I'm lucky they let me out of the straight-jacket long enough to trade.

J. P. Morgan

Friday, October 31, 2008

Obama market discount

Trying to figure this one out.... If it's in anticipation of obama that the market declined... what was the decline in 1980-83 all about....

PAY NO ATTENTION TO THE MAN BEHIND THE CURTAIN.

Phil Lebough

Poor bastard has to go on and defend the car industry on cnbc every day. Financial industry has to get a rescue ... but the car industry.

I'm not waffling that I hate the car industry. I just want an ugly care that costs 4K dollars and that I can run to AutoZone and buy and replace a part in 20 minutes.

Gasparino stoned on the air.

sununu on the warpath

five thirty eight has him with a 5% chance of holding his seat. so Squawk has more of it's morning Crazytalk express to try and help him Keep digging.

McSame and Kudlow play PaddyCake

So that McSame and the Hatemonger Express are on cnbc so the republcans can get elected so that Kudlow can get 3% less in taxes... and guarantee some Kick ass 3 years of Prosperity in the next decade. I'll have you know that during the interview Futures went down 100 pts.

Thursday, October 30, 2008

Hedging

I umn.. this hints at Distribution... I still Lean toward an intermediate uptrend. but it makes me cautious.

Some stuff

Seems like the lack of volatility(trading in a 300 Pt range) may pass... I'm smelling a possible run to the upside.

What I want to point out is the decline in volatility. we were in 700Pt Volatility, moved to 500 and now are in 300... maybe going to 200 pt volatility. I'll point out a "Wedge" of volatility... but that is out a few days/weeks.

Let me also point out that as a pattern in market moves Long term 3-6 months. a Highly Volatile move is similar to a "momentum Low" in that 3 month time frame. and a "Secondary low" within 9 months is Highly Probable. But that should be a Low Volitility low(like the bouncing ball running out of energy, and turning into a slow Roll)

None of this Talks about what will happen in the next 5 years. That is very news and event driven.

John McCain sent me a letter

Lets see what it says(I assume it's my brokerages that give out my name, to these assholes)

"Dear friend"( I think I have to take a shot) Mind blowing that he thinks I'm his friend.)

"I am 100% committed to leading our Party"(yep must be some foolish assumption that the RNC picked up a brokerage list and Jumped to an assumption.)

Bla bla bla... Armageddon if we don't elect him and if I don't give him money... He is broke.

Even better is that it's not for The McSame Campaign, but for the RNC.

Don't get emotional about stock....

I'm always surprised how much I have to remind myself and others about this.

I'm always here to make money.

I'm not here to save the economy, or Tell people how to trade,

To tell people this is or isn't a bottom,

To Convince people to stop drinking the Koolaid.... especially that special brand of Koolaid that Is Our own Hopes and Dreams and Fears and desires.

I'm not here to Argue Economics, Troll Blogs... Etc.

I'm not here to be cool.

To show off my Trading Chops.

To talk about how to trade based on probability's.

To tell people what to buy and when to buy it.

As I have time I try and give out some sentiment, and point out things I see in the market. Give some people some of the advantage what tony calls my "right Brain".

I'm using this bear to start building Good positions in Great Companies, and What I see as a KICK ASS Well Diversified Portfolio, as the Micro bull markets show themselves.

I have limited time. During the course of the day I manage to read about half of the things I Intend to. Sometimes it's beneficial for me to try and put some things into "Words", even if it's my own trading Methods.

But.... It will be a cold day in hell when I sit around and worry about Armageddon... black Helicopters... aliens... Ghosts... unicorns... god.

First, It's a waist of my time to sit around and deal with "Anti-Objects."

Second, That is no way to live. I was remarking on the difference between candidates yesterday, and it's the same old thing a Candidate of Hate and Fear of the unknown, and the Candidate of Hope and Anticipation of the unknown.

I'm happy to have Hope for This planet. And either good or bad... I'm just curious about the outcome.

When I look into the darkness... I see good things... and all pull backs in the market are opportunities. The deeper the better.

Jeff imilt and GE bla bla bla

I never get when cnbc gets all about how somehow some comment that some GE guy made, turns into a 250 point sell off.......

BULLSHIT.... These dumbasses who have tried to sell you on Decoupling...etc

Let me just give you my take. after a 2 day run, Many stops were tight at the end of the day as we ended the day, suddenly for 6 minutes the exits in the market were very Crowded.

There are 3 functions of a market price. Supply Demand and TIME.

sure the price is the price that you can get. But sudden spikes are just that Spikes. and just volatility that will shake you out....

have the past 2 days been a spike... were the last 6 minutes a spike.. sure... But it's the market trying to shake everyone out.... and it will work.

But that it's because Bla bla bla said some random stuff.... It's a thousand monkeys hitting typewriters. At one point one of them is going to hit some keys that you can believe cause something to happen.

But it's could have been caused by a Breeze from a butterfly's wings.

Wednesday, October 29, 2008

Struggling market

I like to see this.....

I like to see this.....

It's good to start seeing the market fight things out, instead of Violent 1K point moves. Almost makes you think some order is coming back to the market.....

I still look at the horror of the Thursday before the most recent low, and the Horror show of 10% random moves in every stock, at random. Looking at the market was like looking inside a bowel.

Productive day

I corrected the music... Looks like about half the music went to dead links.

added one of my newer fav's More Classic sinatra Then ended up on a Nancy sinatra tangent.

Sorry to the females who read the blog. I'm just accounting for my day.

I havn't blogged today

*insert Dribble here*

I'll come up with something.

to be honest... It's just the relief of an uptrend.

Tuesday, October 28, 2008

Backwards Mormon assholes

We get these Crazy Mormons, who as they age, start getting sick... and they become crusaders against Immorality... Because god must be punishing them for making money with Godless movies.

Last movie he banned was the gay cowboy movie.

Gives him a chance to run more showings of "highschool musical 8"

It's always Self Righteous Diabetics, think it's rated R shows and not the Candybars he is sneaking.

Mustard Seeds

So.... I've had it with "Is my money safe" or whatever the crazy crap that they replaced kudlow with... with Kudlow...

If CNBC has me sit and watch what's her face... spend an hour repeating "Mustard Seeds". I'm going to Vomit.....

bumping our head

on trendline resistance there in blue.. Fungibly the broader resistance in red too. someone willl say it's the 10ma

on trendline resistance there in blue.. Fungibly the broader resistance in red too. someone willl say it's the 10ma

Roughly speaking

I just watched the Deathclock move from 10 seconds, to 3 years, to 2 years to 1 year, now 9 years...... it's fun...

I just watched the Deathclock move from 10 seconds, to 3 years, to 2 years to 1 year, now 9 years...... it's fun...

this is a higher high..... We need that higher low tomorrow or so.... but... I hesitantly talk about a reversal.

or even a nice continued bouncing ball action...

In my Chart astrology, a new low is now the least probable.... but still well within reasonable possibility.

Deathclock now 6 years 2 days 9 hours 2 min 4 seconds and stopped. I refreshed it and now it says zero....

bust out the tinfoil hats. I'm sure they will stop the market trading tomorrow.

rally order

Tonight I'll look at the rally order, figure out what is leading here...

but it "Feels like"

Regionals.3 days ago

Tech/retail2 days ago

Materials today

then transports. today

Fed meeting

Another issue could be that the Liquidators are waiting for the fed meeting to liquidate.... So the sellers have dried up through the meeting.

Market smell

I hate to say it ... but the market smells different.

and gartman was on a bearish note last night....

Feels like wishful thinking on my part.

Let me give you another one..... on fastmoney for the first time nobody could get bullish on tech.

More personal interest stuff

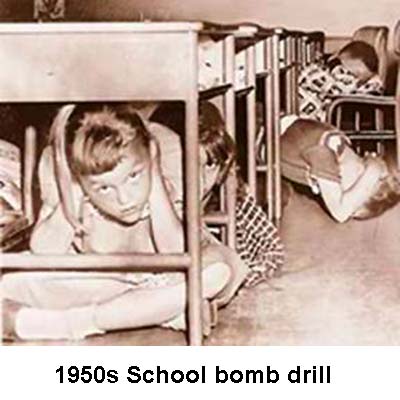

So..... In 92 when Clinton was elected, and as a conscious person, the only presidents I knew were the Fear Monger Reagan, and Regular Nuclear bomb Drills.... That was a time....

But.... I was at University. I had spent the summer on my uncle's gubernatorial campaign. Becoming intimate with every democratic campaign that year.

but So election night, I drank enough Margarita's that I fell down on something and ripped my hand open, 7 internal stitches 10 external. It hurt the next day.... and I have a scar that reminds me of the Clinton election.

Home owners loan corp

didn't particularly buy homes, but helped refinance them

I'm still waiting for the Market to be shut down for a few weeks.....

What a mistake

For McCain to come on CNBC and try and make their economic argument.

which is even more Socialism.

And to blow smoke up everyone's ass. It's mind blowing that he thinks he can make a decent argument. All he is doing is comming on and saying "drill drill drill"

and thinks that it is going to work. All he seems to be doing is coming on and proving what he doesn't know.

He is so used to Politician speak. Very forgettable interview.

and promising only 5 minutes live to protect them from themselves.

Futures

I'm curious if the futures are as worthless today as they have been for the last week. Of course Santelli was defending the futures, because they are accurate for about 10 seconds.

but if we are going to have a good retest.... How umn..... do we do that Up 300

Monday, October 27, 2008

Some charts

My Current official call, is for a spike lower in this pattern, which will be "The near term low", I do think we will come back here in the future to retest on a monthly basis.

My Current official call, is for a spike lower in this pattern, which will be "The near term low", I do think we will come back here in the future to retest on a monthly basis.

This is just a standard Spike lower in a Daily chart. We are all waiting for it. Standard simplisting Chart trading says you have a "Momentum Low"(wave 3) then a follow up "Secondary low" (wave 5).

That is my official call, and Since not today, Tomorrow.....

Now... Other possibilities.... One may think that we will need November options week to reverse this Chart.

This is not my call, but I think it's a possibility.

The roubini Scenerio: he says the market should be shut down for a few weeks... I'm just saying He is always right... so.. Armageddon any day now. after shutting it down, we will see it plunge down 2K+ points... find a buyers somewhere there in the 6K range 650 on the spx.

Somebody was talking about how we need to trade fundamentals, and that they project the roubini earnings which move the Trough valuation of 700 on the SPX. But me I've always felt like the market, when trading on earnings trades on some version of the PEG. If 700 is the Trough, it doesnt reflect the Growth post Trough, which would sugjest a flat Linier regression High 700s, ASUMING WE TRADE FUNDIMENTALS, and assuming we get to $50 in earnings.(That is a ton of assumption)

In anticipation of recovery the thesis is that 6-10 months ahead of time we anticipate the recovery. That is a Bottom to the market somewhere between now and July of next year. But from a 750-850 level on the spx.... One can also assume that we will "let the bouncing ball of the market Run out of steam for 3-6 months.

But with continued "panic market".. who knows what the hell could happen.

We also could let the ball run out of bounce here, but one would think that we wouldn't stay here for more than 3 months, and should at least trade up a little before next quarter.

Financials

I Maintain my regional bank thesis, with slight bias... based on Momentum for JPM. JPM will be the survivor, regardless of how many necks they have cut to get there. And that I hate their guts.

Money will be lent, and it will be your community banker.

Crazy noise on Fast money. We could see some attempts at Takeovers of the big regionals, But I'm doubting it. The big Financials are holding much more in the way of derivatives. So... they will have to dig out of their hole for a much longer time than the regionals will.

From the FDIC takeovers, we have seen some of Mid size banks taking over some of the risky banks.... My point is there is some consolidation of the larger institutions, but there seems to be a bias toward smaller and mid range consolidation. THE FDIC IS TRYING TO AVOID MAKING TOO MANY MONOPOLIES, it seems to me.

Banks that are imploding are always going to be Takeunders. But most of the failures are small banks with no risk management. Where they purchased 90% of their assets in CDO's(probably from JPM).

.

The Wall street Rose colored glasses, and denial on the fact that THEY ARE THE BUBBLE, that they will see 50% Layoffs... etc... Yes, we will see some Big Scale Finance. But if "Fast Money" on CNBC isn't an indicator of Froth on a bubble on an entire industry, I don't know what is.

It's a fun show. but Rock and Roll Investing isn't long for this world.

DeLeveredging the middle east

Crude oil prices are down 57 percent from their peak of about $147, eroding budget surpluses in Persian Gulf states. The six Arab Gulf economies, which pump almost 23 percent of the world's oil, need prices to remain above $60 to $65 a barrel to sustain spending, investment bank EFG-Hermes Holding SAE said in a report Sept. 23. Oil fell to a 17-month low of $63 today.

story

What this should do once again is force OVERPRODUCTION, driving prices lower.

I'm currently a bad sleeper

Sure sell down to the sleeping point but.... I sleep, it's just iradic.... Beautiful game we play. Middle of the night I was concerned that I referenced "The Me Generation", and that the me generation refered to those born 1960-1970. sort of an in between reference. I looked it up.

I was right The Me generation is the baby boomers. It was fascinating, how fungible these labels are. I saw an entire site dedicated to "The Me Generation" and tagged every post WW2 generation as "Me". Probably more a diferentiation between Children of the Depression, and everyone else.

But it's interesting.

First on CNBC: Power lunch

IT'S DIFFERENT THIS TIME!!!!!!

this just has to be it......(I just mean this general area)

Ross westgate in NYC

WOW, I thought I saw him on European squawk last night.

FINALLY the Regionals are starting to trade as I anticipated. Cream working to the top, and the Dogs Showing Their doggie-ness.

Back in the day When I'd negotiate with Contractors, I always felt like there were 2 types of contractors, They kind that gave you "the Truth" regardless of how much it hurt. And those that told you what you wanted to hear, then never delivered.

Analysts fall for the bullshit all the time. It's like the companies like MBIA and AMBAC who it was reported got into structured products because of pressure by analysts. Instead of Doing the tough thing and Just insuring Municipal and Corporate bonds. Suddenly moving into structured products, because the analysts would be hard on them if they didn't insure the structured products..... sure this is also a lame excuse, but nobody was doing the hard thing, "the road Less Traveled"

Point is of the 2 types, those that tell the truth will end up being vindicated, but it will take some time... The others are just riding on a Bubble of shit, waiting for the music to stop.

Sunday, October 26, 2008

Milennial Generation.

In response to The Millennial Generation Is "Spoiled"? Oh, Really?? story on Teresa's site. I wrote this.

They almost sound like the Boomers/Generation "ME"

The Hoisting of the Schiff Theme, 'that America actually needs to produce something', on a Generation that thinks: to Nap, Idea-ate, Text and I.M. at work is normal.

For some reason it makes me smile.

and that the Boomers, now in Very Senior Political and business rolls, are the ones, Leading/Cleaning up this mess.

This almost makes me think there is some form of Socio-Economic Justice.

I had to shorten it.... There is just this fine line on blog Comments that is "Get your own Fucking Blog"

I'm trying to reform my Troll Like ways. (Which will probably never work)..

.... But Everybody is perfect, and they could use a little work.... Right..

I'm trying.

some personal stuff

I took a nap, Watching" enemies of reason", I woke up and had this Urge to get high.

I wonder if my urge to talk about it is part of the Healing process, sort of "Acceptance stage"

Many many years ago I gave up getting high. I gave up smoking a some time ago. October 1 was the anniversary, it slipped by this year Without notice. Which is new, I tend to remember.

The interesting part is that that was a catalyst for a ton of change in my life... or it was one of many things that changed for me in a 2 year period.

So now the closest I get to "Getting High" is working on my garden, or Endorphin Buzz of a good work out..

Guess it's a good day to clear the garden.

Ok, One more

And not about greenspan.... I swear. I fell asleep early and now I'm up late.

For the first time in 4 years or so, I found myself watching Southpark... Mostly because "they jumped the Shark" Roughly season 5 when they actually Killed Kenny for a season.. .maybe it was 6. Probably just after Kyle got the Hemroid, that almost Killed him, and that was proof that there was no god.

Well it started off as an Homage to Buck Rodgers.... and not to go too far on a tangent You have no idea how hot I though Erin Grey was.

Just to give the Clift's notes version. People like Richard Dawkins need to lighten up, and not be such Zellots. In the end Cartman Gets sent back to his real time because he Breaks up the Love Affair with Dawkins and Mrs. Garison... Because Cartman tells Dawkins, Garrison had a sex change. I'll spare you the imagery of Dawkins actually doing Mrs. Garrison... which is when Dawkins finds out.

Lets just start with the fact that ... Ok, I'm not sure about this... and I'm too ashamed to look this up, because I'll get off on some other Tangent. But As I remember at one point I thought I had the impression that Dawkins is actually a Homosexual. My point is, I don't care.. Nor do I care to verify this as a fact.

The idiocy of Southpark saying that Dawkins is Gay... Is Embarrassing for them, since it's about their take on everyone and everything. NOW, that it could be Ironic(If it is)... is slightly funny.

Now this is the point where Tony shows up and says "Dawkins is 100% on the money". Alright I understand.. I don't disagree. BUT There is a point where one takes Evolution by natural selection(Which is effectively Fact) to the point where it is Religion, and to a point of Zealotry. NOW, I'M NOT MAKING THAT STUPID ARGUMENT THAT SCIENCE IS THE NEW RELIGION. What I am saying is that some dumb asses out there need a Religion, and have decided to make science their religion.

My only real attack on him is this: he sees natural selection as the Yin to Creationism's Yang. That is the problem. They are nothing alike, Creationism isn't even a Theory.. It doesn't even have any Facts, or evidence.. It is an insult to natural selection to even talk about creationism in the same Realm as Natural Selection. DOING SO, GIVES CREATIONISM an amount of VALIDITY, that it doesn't deserve... In fact, that is half the point of these Yahoo Moron Creationists, who say "Teach the Controversy"... there is no Controversy... Just blind stupidity. Just to Argue against creationism, using natural selection is to give Creationism TOO MUCH Credibility.

To say that we were "Created" using natural selection, is an Error... We were not created, the universe was not created..... We Just Are, and moved from being what WE WERE, into what we ARE NOW. There was NO CREATION.... THE GREAT "IS", Always HAS BEEN And Always Will Be. The Big Bang DID NOT come out of NOTHING, it was always SOMETHING. We Came from That Something Into What Now IS.

Next get me on how Just to Argue Theism, is to practice theism. And should be avoided at all costs, and not what a self respecting Atheist should do.

And... Don't get me started about Greenspan

We all know how I hate the "Laissez-Faire"

(BTW the only reason I can spell it is because I finally posted it on a sticky next to the computer.)

What I need to do is start my constant emailing of my representatives about making companies NOT too big to fail.

Legal Compliance is voluntary.

So... I was looking at documentaries... ran across the landmine of Documentaries... and no not the Libertarian, black helicopter documentaries... Cause I love those. almost as much as zombie Pictures....

but... I run into some Kent Hovind Evolution debates, I Wrack my brain trying to remember who this nutjob is, and if I've seen them. so I Wiki him, and realize I had... In fact these debates are why I refuse to watch the Creationism vs natural selection debates. Not only are the arguments so bad that a High Schooler could shoot them down. But they are Super long and Booring.

I read that they threw him in jail for Tax Evasion... Not only that but he is one of those "Tax Avoidance guys." Which is one step above a "Tax Protesters".

Tax Protesters refuse to comply until Compelled.

As opposed to the Tax Avoidance people who don't get that when the Tax Code Says "Voluntary Compliance"... Voluntary Refers to Compliance, and not to the Tax. Taxes are Compulsory, But you Offer up your money every year... Ergo Voluntarily Comply. It's like voluntarily surrendering yourself where there is a Warrant for your Arrest. You choose to Surrender... Or voluntarily Surrender, It's either that or they will keep after you.

What a bunch of dim bulbs. BTW My dimwhit Brother who because of 4.50 gas and peak oil purchased a motorcycle... Which is cool, but it broke his heart when I told him the next stop for gas was sub $3.00, and worse it could go to $2.00. I'm not sure if he Sold his big fat Dodge Pickup V12... But probably at a loss.

Which sends me into 40 minutes of Laughing about how these assholes think I should provide roads for them to drive on, and police and fireman to keep their shit safe.

They will let you have a car that drives over 75MPH, and you voluntarily comply with the law, but if you are caught Not voluntarily complying, they throw your ass in Jail.

Saturday, October 25, 2008

On friday the treasure started giving the candy out to the regionals

Happy to say that every bank but 2 that I own have now been given Free Cheeze. Starting to be sad The ones that just announce i don't have more in them... we will see how they trade on Monday.

I don't own it, but I suspect that Fifth Third(FITB) will get some Candy, but may not announce it... EXCEPT there was a NASTY bear run at it on friday, kicked off buy GS... so Place your bets, Either they are about to collapse and get acquired, or it was a Bear run in anticipation of a Reversal.

Keep an eye on Monday, but if they don't announce free Cheeze, ........ I would not be optimistic of near term performance.

Roubini

Jumping the shark.

It wasn't noticed but on Squawk he said he wasn't an investor... roughly he said "maybe some indexes, sometimes"

The financial panic set up by them shutting down the Markets, would be worse than it is currently. LONG HELD is the idea that you don't shut down the market.... NEVER NEVER NEVER.. sure historically there are some times where we did shut them down, but it's more because of bombing threats, or bank holidays, which were more bank stories than market stories. I'm a huge believer in markets HUGE, The confidence of Price discovery one could suggest is the strength behind the dollar. The more we allow the market to be irrational, the more likely we will come back to sanity.... It's like allowing someone to have a nervous breakdown... after it's over it's kind of like... "See, it' wasn't all that bad, now was it."

There is a video here

Where he said "If I were an investor, Stay away from everything but Treasuries Foreign treasuries". Commodities, any dollar assets etc.. and he looks hung over. If the dollar is going to Collapse.... You want to be in dollar denominated commodities. In this interview You get the impression he actually believes the market is going to 2K..... If it is... so be it...

That kind of sentiment, feels like a bottom... again... and feels like Roubini has jumped the shark. I'm not saying he is Wrong or an idiot. He just isn't JESUS of the financial markets. He works at NYU, and spends his time Blogging for god Sakes!!!

When the market gaped down on futures, then traded so thinly that it made it jump. It makes me more optimistic. Panic sellers had their chance, and didn't go.... It's a very good sign for the market. I don't see a limit down again in our future, it would have been too much of a money maker to have Purchased that "limit down".

This just puts more chips in the the market is acting like a bouncing ball that is running out of bounce idea.

Friday, October 24, 2008

Just some fun stuff

I had to run to Obama headquarters today, to get some signs, I figure if a Black man is going to win the Presidency(Knock wood), I need a sign.

but...

Months ago I told Y'All about my buddy who purchased Yahoo after he heard it on NPR for $100. Well The Obama HQ is right near the Investment Property he picked up. Now get this, He picked it up in the 2-3Mill range, Not Alt A or SubPrime BTW. But it's.... 2 Small Apts for about $600, and one Much larger that goes for $2500 a month. That rental is a VERY EXPENSIVE unit, More expensive than buying a modest house here. But it's big and has a great location. Point being if you can afford it, you can afford a nice house.

Well He picked it up fall of 2006. I havn't talked to him.... but it's up for sale. I bet he is going to get Killed on it.

Feels like

This feels and looks like a short term reversal pattern...... I'm nervous about saying this. I guess my thesis is that With my rule of 3's This is just a short term retrace of the last 3 days... a 50% retrace... As opposed to the one I was talking yesterday, because you should break down after that retrace... So it seems like the market needs to go back and get more sellers.

Lookie

Lookie there. so.. this continues to point to the "rubber band" running out of energy Idea... Which is that we will grind it out for the next few months. Now... I'll stick to my Spike low call.... That is my call, I'm sticking to it.

Lookie there. so.. this continues to point to the "rubber band" running out of energy Idea... Which is that we will grind it out for the next few months. Now... I'll stick to my Spike low call.... That is my call, I'm sticking to it.

Carter Worth

Holy shit, He was on talking about how Right he has been. WFT, it's like nobody is paying attention.

This is the second Bottom he has called. He called a Crash in July, that never happened.

To be honest, he has been as correct as flipping a coin. And after the August Sell off into october highs, he was correct. Until Jan. After that it's been Foul balls.

bill gross

and pimco are sad today because the Armageddon call they made this morning has yet to come to pass.

shanghai

I was curious how close the Shanghai was getting to that 1K level, remembering that it was at 8K not to long ago. Epic sell off that will keep investors sidelined for decades there. Truly a 1930's version.

so its 1800. like a 2% sell off there. Not so bad...

So, the XLF I'm dying to know if it can print a 10.

What I'm also dying to know is if there is actually some deleveredging or if at one point today we go "Why are we selling? Because of Asia and Europe? Fuck Asia and Europe."

Back to being an asshole this morning.

We have Created the "Great Depression" MEME. Time to live with it.

good luck everyone.

Why buy till it's priced in, we need to De-leverage all these hedge funds treating the market like It's Las Vegas. It's not a sustainable model.

We have sorted out most the Ibanks, And they have finally started Laying people off. Time to make the Hedgies as Scarce as Spotted Owls. "Who wants to be on WallStreet. It's filled with losers with no ability to risk manage."

"Hedge fund"? What is that? They are Twice as useless as I-Banks.

Hedgies need to start sounding like the I-Banks "We didn't understand that the Business cycle applied to us"

Who needs to pay 2% to lose money like this..I'd say 2 and 20... but.... LOL.

Then we can pull everyone's credit cards Repossess some Cars and ATV's and finally this can be over.

Sometimes I joke

about trying to price in Armageddon, but we may just have to do it. Like I've said, once you create the meme, sometimes you have to live with it.

some signals

Some are conflicting.

We have the "Barry" "Look out below" short term buy signal, which is usually a wed-thursday signal that turns into a short term(one day) bounce.

Beyond that we also have the "Trading curbs" bottom signal.

Here is the conflict, on the first one it's not wed-thursday. And a good bottom is a monday-Tuesday thing.

I'll stick to my Monday-Tuesday bottom call. there is a high probability of a nice sell off this morning, with some bounce, I don't expect us to hit the breakers. If we get a good bounce... We may not get a bottom till, November Options expiration.

Fun

Limit down futures.

Down 60 on the spx

Down almost 550

Naz down 85

Funny funny funny.

They are saying Hedgefund redemptions.... and sure this is deleveredging. But you can't say that all the global selling is one big hedgefund.

but... if you are leveredged, time for you to go away.

"They say" that anytime the futures are down this far, you have to buy.

Thursday, October 23, 2008

Super Nerdy Political Statistician

Check this out.

it's political statistics Taken to the extreme.

It shows that that IBD/Tipp poll has McCain ahead 74-22 among 18-24 year olds.

And yet the day before it was 53-43 the day before.

That is a huge 1 day swing from an already ridiculous number.

Another thing

I keep being more interested in C-Span and politics these days, Or C-Span about economics. Its much better than listening to dennis Kneal. So, I was watching some committee or another. and Shelia Baer and the Bald guy in charge of the tarp.

Now I can't remember what I wanted to Whine about...

Not like I care

One would think I'd stick to the market... But WTF do I care. So, I'm working on today's yoga thing. Tough stuff, I can't believe how hard it is these days. Not like I make it easy, So today I'm trying to get past the 30 minute mark. I realize every 5 minutes there is 3 minutes of commercials, sure it's a good chance to rest. But Damn, that is a lot of Holistic Healing commercials(Of course it's holistic healing commercials you get during a Yoga Thing.)

Piss on you if you don't care about my Yoga Trials and tribulations. I am getting to the point where I'm feeling better.

NOW.... Do I get credit for Calling a descending Triangle and not a Pennant?

Bill Fleckenstein

Bill Fleckenstein is on Fast money, talking about how we need to learn from this cycle, and how we need to go back to the Volcker Esq system.

He has a great point, and yet. This is the Cycle, 30 years of easy money. It bites us in the ass, we say"we need to learn this lesson and never do it again". Then after 15 years some Asshole in congress gets Volcker out because he doesn't have an easy enough money policy. Which means the economy has to actually grow, as opposed to "Pretend Grow" by inflation. Housing prices stay flat, People can't get "raises by inflation" which are all advantageous to the "uber Wealthy" and the corporations.

What I'm getting at is that There is no "Learning" from this. We swear it will never happen again, and it's just human behavior. Jimmy Carter will be elected, all the economic problems will be blamed on him, since they will be more apparent over the next 4 years, as we come to terms with the problems "Nixon" created.

As smart as Greenspan is reported to be, Problem is he is just a rat in a cage with everyone else. The Great "To Do" off of all this, is just to know it happens, and it's unavoidable. Anticipate and make money.

things rhyme and don't repeat, and unless the Fed becomes very stingy with rates over the next 5 years, forcing a stagnant economy it will become inflationary.

These are generational problems, Greenspan saw the tough money policies of the 70's and said the same thing that they said 40's-50's "What we need is more Loose money"... It's just a cycle, what we really need to learn is that the cycles are unavoidable.

What is avoidable is the extremes.

40 year flood

BTW I love that Greenspan today said... "my model was good" as long as you ignore the 40 year Credit Cycle. Basically he said, as long as you play the 30 year loose money cycle with my model it works.... Which is what makes it the cycle.

I've held for a long time that Greenspan never had any idea what he was doing, and just did "the road most traveled" Just like every other Fed, Give out free money till you can't anymore.

Well.... that was it...

92.4 was the target 50% retrace + a few pts on the open and it's done....

92.4 was the target 50% retrace + a few pts on the open and it's done....

Now ... I can make a good case for a pull back into a wave 5 finish.... It wold be nice to see a good run to 100 on the SPX.... Too bad the market doesn't trade "Nice".

Financials Sentiment

The last 2 days the financials which were outperforming have been trying to retest, like many sectors that have already retested and failed.

It's interesting. the earnings, which as nobody noticed, arn't getting worse. And some show getting better Slightly. Depending on the shit you have on your books.

In the end of the day there are 2 important time frames, what happens in the first 10 minutes, Sometimes you can move up for 10 minutes then sell off for 5 and have it crack the market... but besides the 10 minute trend, that is predictive, sometimes there is the 30 minute mark that can be a pivot point.

So a chart

This is wave 4 of the trend since "The Bottom"(I say this tongue N Cheek) This has a move down then we should get either my bounce toward 100 on the SPY, or toward 94.5

This is wave 4 of the trend since "The Bottom"(I say this tongue N Cheek) This has a move down then we should get either my bounce toward 100 on the SPY, or toward 94.5

a chart

So... This has yet to be a 5 wave move. Theory suggests that we move back toward 100. then break down. The current 2 day sell off looks to me to have a little more in it, to the downside. ..... Umn..... This still leaves to possibility that we would break to the upside... then break down.

So... This has yet to be a 5 wave move. Theory suggests that we move back toward 100. then break down. The current 2 day sell off looks to me to have a little more in it, to the downside. ..... Umn..... This still leaves to possibility that we would break to the upside... then break down.

It is interesting that we broke to the downside...... But seems obvious it's a little descending triangle

5.2 billion

Not that 5.2 billion is inconsequential... and in the world of Wallstreet Bullshit, the Illusion is reality. But the Lehman CDS settlement worked out to 5.2 billion.... I hear. Who knows if anyone ended up without a chair. But The 700Billion, that was Shouted from rooftops, of the Crazies.

Of course, you knew the 700 billion or 300 billion was just the number of swaps, and since Some were purchased, some were sold. The question was how many more Shorts there were than longs, since the Gross number counted both shorts and longs.

but it just goes to show how irrational things are, not that 5.2 billion in the wrong places couldn't be extremely painful, But that the Gross number of swaps was being quoted and no notion of the Net number was even being discussed. And maybe it's understated and its more like 20 billion... but... 700 billion..... WTF... but Illusion does become reality for some people. And reality for many people does have an affect.

I saw some analysis that said the Pennant was still valid.... I looked at my charts... Seems like wishful thinking to me.

As much as I'm talking about descending triangles, there is a good chance we will drag along the 8k level.

Joe the Plumber REDUX

Good that Obama has been hitting on Joe the CEO and Joe the Hedge fund manager. This whole argument is such a joke. There is this problem in America, that people are more interested in defending the person People think they are, and not the person they actually are. Where Joe Wants to protect the interest of a person making $250K, But he is just a regular guy making 40K.

So there he is Defending the idea that at one point he makes $250K and moves from 32% to 36%. I've run a small business for just under 10 years, and There is no doubt the tax Rates are rigged. I've never paid so little tax in my life. Obviously not as a Number, but as a Percentage. I'm always surprised what I can deduct, and all the little things that as an employee I have to pay for, and yet as a business owner, I pull them out of my taxes.

I remember One guy I was working with who had this idea that Somehow the Taxes Paid for Things, and never got that all I get is when I buy a computer. It reduces My Taxable Income, I don't get a free computer.

I just saw the Joe the plumber interaction with Obama, and he doesn't even vaguely understand how the system works. It's obvious that he has never, and will never run a buisness. Thinks that if he buys a truck Somehow the taxes 3% more taxes will crush him. And yet, He doesn't realize that if you buy a 60K truck, that pushes you under the 250K level, and you are Taxed less. They never get that YOU HAVE TO MAKE $250K to be taxed at that level, Not Gross, BUT NET PRE TAX $250K, to get a tax increase. Which is an increase of about 8K. What a fucking tragity. And trust me, Buisness' Deduct so much borederline "personal/Buisness" expenses. My ass will never Bleed for them.

My point is more to point out that people fight for who they want to be, not who they are.

I even saw a conservative Pundit, try and make the "flat tax" argument, Not realizing that even being taxed in a Flat way as a percentage, is socialism. I mean if the "haves" had their way everyone would pay a single dollar amount. A sort of Pay per Participant in our system, of course that means that each child must pay. So we Heavily tax families, which I'm not against.

Not sure if it's my age, but it just seems like politics managed to hit a High point in stupidity in the past weeks.

Wednesday, October 22, 2008

Re-Combobulate

I've been trying to get back to normal a bit the last few days. I haven't made a run, It's cold going to have to adjust. 4 months of it being cold. I always think winter is a short time, and yet it's not 4 months and spring will start... a little earlier the snow will clear. But still 4 months till a Whiff of spring, it's still Nearly half the year, under the nightmare of the Holidays then the Nestled in the Batcave feeling that Jan and Feb bring. I guess that is the reason for the holidays, get our minds off of Winter, get us through those months.

Oh... So Hopefully I run, but the last 2 days I've picked up on a little Yoga... that is my Backup activity during winter.... And OH BOY I SUCK. Yesterday I made about 20 minutes, today 35 with 2 breaks..... it's a combination of being uninterested and it being hard and that I'm overdoing it. and my flexibility sucks.... I used to be able to pick up yoga easily and it took some time to adapt but overall the Switch over was easy. This just goes to show the physical condition I'm not in..... but.. Every journey starts with a single step.

Sorry no chart

We have broken the pennant. And we have what looks like a descending triangle.

My expectation was that we would break it to the upside. Then reverse and go lower.

many times when you break a pennant, it goes the opposing direction it broke. (it broke down, So we would go up).

honestly i don't know. I'm more optimistic than I was before.

But again, a nice spike lower on monday/tuesday.... We have played that game before.

trying to post

I was just very annoyed by Maria CC.... it's something... I saw a great comedy today "the paper". Nice documentary about Egyptian engineering.

Suffer for honesty

Nice to wake up this morning to the Sunshine from Roubini. Apparently the market has to go down to 3K... then we can muddle there for 4 years or so. It's good. At one point I keep hoping the market will realize that it has to earn it's marks.

I spent most of yesterday Listening to Earnings Calls, I always respect a company that can do an earnings call in less than an hour

Tuesday, October 21, 2008

I was quiet monday

..

I feel like I'm coming off of speed. I cant remember a day when I wasn't constantly checking to see if the world had come to an end.

Maybe it's today.

Same ol' cnbc nonsense 'Stocks went up because Uncle Ben is cutting us all a check'... The local news said the same thing "Free Money Again, We will keep you posted" Every one will be dissapointed when it's just that some bridges get fixed, and some potholes are filled.

I'm just enjoying that things are ... well nothing has blown up lately..

Monday, October 20, 2008

Saturday, October 18, 2008

Fed Rethinks Stance on Popping Bubbles

"[O]bviously, the last decade has shown that bursting bubbles can be an extraordinarily dangerous and costly phenomenon for the economy, and there is no doubt that as we emerge from the financial crisis, we will all be looking at that issue and what can be done about it," Fed Chairman Ben Bernanke said this week.If your job is to help clean up the mess, you can't help but to have the responsibility to be preventative.

if your job is to deflate the economy, your job to also to make sure that it doesn't get dangerously inflated.

you can't have one responsibility without the other.

Friday, October 17, 2008

money managers

After all this.... The idea that I would ever turn my money over to some Psudo "financial wizard". And worse is that even if someone has a real wizard.. the tenancy is to not listen...

Funny I keep getting on the phone with friends who are filled with panic.

I never know what to say.

yields

the 3 month yield moved from .3 to .78 today... which is good

the flight to safety... though the hedgies have moved to cash.. they probably have moved to 3 month Treasuries

some guy... and what is next

Was talking about communications leading the way out....

I am curious What will lead out out.

He says his daughter won't give up her phone Therefore communications.

We need an industry that we all can work in, and not healthcare... that will just bankrupt us... taking care of the babyboomers as an economy. Maybe it could be sustaining.

My buddy update

So, my buddy is off to see the his Parents money manager.... UGH!!!! Can you imagine a portfolio manager in SLC Utah.... I know a guy who works for MS... and he is a complete dope

this is awesome

Last month, he did the unthinkable -- he shut things down, claiming dealing with his bankcounterparties had become too risky. Today, Lahde passed along his "goodbye" letter, a rollicking missive on everything from greed to economic philosophy. Enjoy:

I was in this game for the money. The low hanging fruit, i.e. idiots whose parents paid for prep school, Yale, and then the Harvard MBA, was there for the taking. These people who were (often) truly not worthy of the education they received (or supposedly received) rose to the top of companies such as AIG, Bear Stearns and Lehman Brothers and all levels of our government.

Meanwhile, their lives suck. Appointments back to back, booked solid for the next three months, they look forward to their two week vacation in January during which they will likely be glued to their Blackberries or other such devices. What is the point? They will all be forgotten in fifty years anyway. Steve Balmer, Steven Cohen, and Larry Ellison will all be forgotten. I do not understand the legacy thing. Nearly everyone will be forgotten. Give up on leaving your mark. Throw the Blackberry away and enjoy life.

Of course... if he were a stock... I'd go short. But I think... so would he.

the 76.4 retrace and the 61.8

is the 97 level on ths spy which we are struggling with... the 100 level is the 76.4 in our pennant

also trenline resistance at 98.5.. as well as some horizontal and more trend line in the 101.7 or so level

interesting

it was interesting that they bid them down this morning... almost like the call buyers wanted the stocks.

Thursday, October 16, 2008

Joe the plumber

Just to start ... hopefully we know

not a plumber.

Not going to buy his boss' buisness.

his boss' buisness not worth over 250K

Makes 45K... would get a tax break from obama.

But

Best Part Member of the Natural Law Party

The party based its platform on Maharishi Mahesh Yogi's view that natural law is the supreme organizing principle that governs the universe, and that the problems of humanity are caused by people acting against this natural law. The Natural Law Party claimed that it could realign humanity with this organizing principle through techniques such as the practice of Transcendental Meditation and TM-Sidhi program, and problems would be alleviated.

So .... I don't buy the retest

The motion suggests just a slightly lower low.....

But the week before the 87 crash... Options expiration...

I'm hoping Teresa and pete tell me what to think...

Cause you know, it's easier that way.

This should be the last week for the hedgies to raise money for redemptions... Of course that is probably just something I heard out of the talking heads...

some stuff..

Tick values have been ridiculous to the negative side.... does that indicate that the aggressive selling has been met with enough buying.... and that it's hard for it to get more aggressive. I don't even know where it is on a relative basis.... I didn't watch it on Friday.... but this has been extremely negative.

Tick values have been ridiculous to the negative side.... does that indicate that the aggressive selling has been met with enough buying.... and that it's hard for it to get more aggressive. I don't even know where it is on a relative basis.... I didn't watch it on Friday.... but this has been extremely negative.

besides all my talk

we are starting to play with the down trends.... and the tick values over the past few minutes have become positive

we are starting to play with the down trends.... and the tick values over the past few minutes have become positive

Developing Descending Triangle?

It's interesting that there wasn't a legit retest.... we may still get it. But we overall need to get past the green and blue lines. marking developing Descending triangles.... also we could run a nice Pennant.

LOL JPMorgan and the CDS market

Of course the evil bastards at JPMorgan created the CDS'

Long celebrated as a way for banks to diffuse their risks, the credit derivatives invented by Demchak’s team have instead multiplied them. The new credit vehicles encouraged banks and other financial firms to take on riskier loans than they should have; helped increase leverage in the global financial system; and exposed a much wider array of financial firms to the risk of default.

A lot of blame has been sent toward minorities

for the sub prime crisis. What do you have to say about this.

M.C.C.

In the 30's the blame for the depression was placed on the Jewish bankers.....

Charles Coughlin

Father Charles Edward Coughlin (October 25, 1891 – October 27, 1979) was a Canadian-born Roman Catholic priest at Royal Oak, Michigan's National Shrine of the Little Flower Church. He was one of the first political leaders to use radio to reach a mass audience, as more than forty million tuned to his weekly broadcasts during the 1930s. This radio program included antisemitic commentary, as well as rationalizations of some of the policies of Adolf Hitler and Benito Mussolini.[1] The broadcasts have been called "a variation of the Fascist agenda applied to American culture".[2] His chief topics were political and economic rather than religious, with his slogan being Social Justice, first with, and later against, the New Deal.

We can look at this

Like a wave 4 up move, resulting in a wave 5 down move... that retests the low today. Or that will run till tomorrow then see a sell off after options tomorrow. Into our nice capitulation on monday tuesday

Oh The hell

Peter Schiff on "the Call"....

NO!!!!!

Wow... Much more lucid... Wow... Very subdued... maybe Dylan had a talk with him.

We could get one more high here... or a failed high

What about this

We bounce off the lows today... rally till options expiration. Come back and Kill the lows.

Damn.... Rig at 63....

it would be wild to see the market just melt up wouldn't it?

when I say start of acumulation

I hope we know that that needs to go on for a few days. We are going down 2 pts on the spy at a time... next stop 84 we should get a nice bounce there.

We are going down 2 pts on the spy at a time... next stop 84 we should get a nice bounce there.

Bond yields are flat... except the 3m-1year. that are up... but .31% on the 3 month isn't that exciting

compression accumulation

40 pts away... we are seeing some Compression of the move... and some start of accumulation... sort of... Seems like a nice Monday/tuesday wash out is in the cards. but it does seem like we have run out of downside energy short term

You know what I'm excited about

conference calls.... I miss conferenced calls. Listening to companies lie about how buisness is... or just show that they don't realy know

Futures are up big

I can't imagine the hedgies aren't going to liquidate right into it..... but it's some nice start to some Chop.

Futures

Went from +3 to down 7 on the spx....

To have any chance of a "Slightly lower low" We need more chop.

What I see, is either this has been a pause this week in a much larger move that is half way done....... I'm not sure what part of the previous move it's half of....

or

we can get some "Chop" and get either a slightly lower low, or double bottom or other variation of sideways.

Yesterday I was talking about how we had 2 full updays, the 2 down days. if it goes 2.5 down days... we lean heavily toward Bearish.

TK was talking about flushing it out this morning... but it doesn't feel like that. This feels like a descending triangle forming, so we will probably test, bounce then break the lows.

*shrug*

Not so much a fun game.

Wednesday, October 15, 2008

ugh....

I'm just going to rant here. I think putting up with the market is about all I can do. It's interesting how we are in this Political... upheaval and the market upheaval. I guess it's not all that crazy... Social and economic crisis hand in hand.

In other news, My parents 50th anniversary is coming up. My sister showed up at my door... Isn't that nice... of course that I don't answer the phone doesn't help... Apparently we are throwing a party..... My mother has 14 brothers and sisters, with an average of 9 kids each... with an average of 9 grand kids each who now have 9 kids each... They are like Rabbits. Now apparently I have to feed that is roughly 10,000 people.... sure I'm being overly dramatic... but even leaving out 1 generation. it's 1,000. One thousand people I don't like....

Better yet, then my sister thinks that her job in organizing, is to tell me what to do... We have a good organizational system, she tells me what to do and I'm supposed to do it.

So, I agreed to clean up and to punch and cookies. She had a list of other shit for me to do... I volunteered her to do them all.... then her son, and her husband... I figure if she can volunteer me I can volunteer her family.

McCain

There was a Frontline special last night, which left me not impressed. He feels very entitled to me.

grrrrr Sleep then the market nightmare.

Holy shit

McCain is a racist... The subject was "poor education" and he thought is was about equal opportunity for minorities to education. He just jumped to that conclusion. As opposed to how poor our system is.

I hate this nonsense

McCain says that he repudiated anyone saying something improper...

What a disparate sad man he is to try and call Obama a Terrorists. I had respect for mcCain at one point. But this is beyond crazy. It's an embarrassment to America and reflects what is wrong with our sysytem.

LOL Fast Money Hell

Finger pointing, Blaming politicians for allowing free markets.... It's awesome... Somehow they had to save Lehman.... and it's because the free market took out lehman... that the free market has no confidence.....

I can't even follow about half of this..... It's all so Alice in Wonderland....

And not the good kind of Ass kicking Alice.

momentum low now a secondary low we are working on

feels like an attempt at a double bottom... but the only streghnth I can find besides banks is rails.

these moves are obsene

So.... if we assume my 1:20 bottom call holds..... IF IF IF IF IF IF IF...

and I measure time vs the swings.. We had a 2 day move up (Tuesday morning, from friday morning), Then a day and a half sell off. We could get a day and a half up move which puts us......

FRIDAY MORNING OPTIONS EXPIRATION!!!!! as the next swing.

My new super secret indicator

My 401k civilian buddy, Tuesday emailed said "Now I want back in"...

Just emailed.... "now I'm glad I'm out".

LOL...... He rocks

Just for tony

this is what I think.... Maybe not a new high..... but 1 or 2 day or friday morning uptrend..... Swing....

this is what I think.... Maybe not a new high..... but 1 or 2 day or friday morning uptrend..... Swing....

I thought it was super funny.

Roubini has to be Jumping the shark at one point, Suffering serious Hubris, Starting to think he has some kind of New Age Financial Nostradamus. Was it you who pointed out his Social networking page?… if that isn’t strange enough… maybe I dreamed it. I would hate to look for it again and have to come to terms with the Reality of it.

Which reminds me “The 7th Seal” of the CNBC Apocalypse is to have Roubini and Schiff at the table on Squawk.

After 15 minutes, Kernen would start Crying, then excuse himself to go home a hold his kids for a few Months. And then they will pull out Carving Knives and dine on the flesh of Liesman, While Becky and Carl Watched in Horror.

Duncan Niederauer was talking today, about how “The Media” had started a rumor today that the NYSE was going to be shut down. I thought it had been started because of all the talk and posting about the “Circuit Breakers” this morning.

I guess it could have been Roubini,the media got it from, I’m not sure how shutting down the Exchanges for a few weeks stops the De-leveraging, but Delays it… I guess I can give him a Mulligan on that one, since as he said the other day “He isn’t really an investor”.

In Truth, I’m just bitter because over the past 2 months I’ve gone out for my 4am run coming back with a nice Endorphin Buzz, Just to see him on squawk and suddenly I have the urge to hang myself.