.png)

.png)

.png)

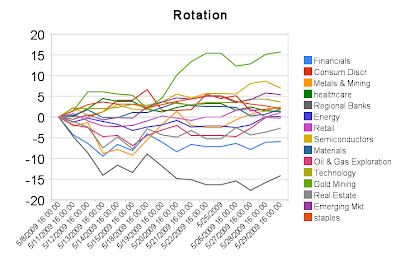

The chart since early may isn't in order but...

Gold mining +18.89

Emerging markets +4.65%

healthcare +3.21

energy +3.11%

Energy Exploration +2.67%

Financials +2.31%

metals mining +1.54%

staples +1.20%

Regional Banks +.81%

Materials -1.82%

Technology -1.99%

Semiconductors -3.06%

Real Estate -4.42%

cons Discr -5.29

Retail -5.46%

Financial history doesn't repeat itself, but it often rhymes. You can't be stupid enough to trade off anything I say.... I'm lucky they let me out of the straight-jacket long enough to trade.

J. P. Morgan

Sunday, May 31, 2009

Charts again

Rotation

.png)

Worked on these charts this weekend.... I need to get the key to do a descending sort. One chart is since the early May high, the other is from the March low

Friday, May 29, 2009

The Third option in trading.

I have heard a ton of frustration out there. It's funny... I tend to think about what I want to do in the market, then try to remember that, at this point most the traders feel the same way.... Then GAME MYSELF.

Me and every other Piece of shit dog trader is just trading short term. Taking the Kibble and feeding the dog.So...

Like I've said for days. you don't want to play this.

I hate to do this... This is what I have. these are the targets I have.

I have 2 at 94.50, I have a 94, I have 2 more that are a breakout above the last high, and one that is the last high.

I have almost no confidence in any of them. More end of the month money comes in on monday.

Way back when, I used to read Accumulation/distibution based on the shape of these moves. and as I read it this is more Distribution than accumulation.... but mix in some of that Fast money... and you get moves like this...

So to not bullshit, I'm looking at 94-94.50.... but the other thing to watch is that large ass pink BearFlag...

I just want to congratulate Joe Teranova, for having this market down for the past 2 months. And for having this trade Straight up!

So maybe 93.50 is the best bet....

What I was getting at is that there are sometimes third options s in trading... which is pull your bets and wait for things to be Clearer...

a read

I'm trying to come up with a definitive read here. It's impossible to not talk about the break out. You have a potential new high. I was doing elliot waves and was not convinced.

I'm trying to come up with a definitive read here. It's impossible to not talk about the break out. You have a potential new high. I was doing elliot waves and was not convinced.

but it just seems like a nice consolidation for a move higher. I guess you have to say cautiously optimistic.

but you can just talk about window dressing. end of the month...

sellers

so... they arn't going after this aggressively. but... seems like selling will have to be natural.. and people will just have to want to step out of the market before the weekend, for this to go bearish.

so... they arn't going after this aggressively. but... seems like selling will have to be natural.. and people will just have to want to step out of the market before the weekend, for this to go bearish.

I wonder how many people are sitting on stock.. just "hoping" for a continued trend.... and a sort of natural erosion will happen.

one would expect just some slightly negative ticks for that.

hard choice

Listen to Kudlow whine about how bondholder are taking a beating....

Or.

Sharapova is playing

murray is playing

ferrer is playing

I've had it at this point, Liquidate. Let Toyota and whoever come in and rebuild. No Bullshit restructuring. LIQUIDATE.

correction

I think we can call correction at this point.. maybe... as a double top it breaks the 875.

I think we can call correction at this point.. maybe... as a double top it breaks the 875.

but we do have an uptrend of the Pennant to fuck around with.

trade of last resort

I talked about the sort of breakout move on the trendlines..... But... as we have learned sometimes the "Breakout" is the trade of last resort. and is sort of a fakeout... and happens on the trendlines as well as it works for the 2 Dimentional brains.

I talked about the sort of breakout move on the trendlines..... But... as we have learned sometimes the "Breakout" is the trade of last resort. and is sort of a fakeout... and happens on the trendlines as well as it works for the 2 Dimentional brains.

Read

I have such a bad read on this pattern.... seems like we are getting that secondary high, Just in time for the 11am sell.

I have such a bad read on this pattern.... seems like we are getting that secondary high, Just in time for the 11am sell.

Who knows where the correction will go but....

I just have such a terrible read on this pattern... It feels like a Bull flag. and now a sort of "double top."..

maybe after the Up and down beating from the market.... I'm just lacking confidence, and expect the range bound to continue, instead of a resolution to the range.

Return of the meme...

It's much easier to trade with the french open in the background and not .... "The talking heads"... I'm much less stressed without a need to try and dig through the nonsense going on.

So, We have this new "interest Rate Meme."... I have been wondering if we will get the old "Mad Max MEME back.".

Won't that be fun.

charts

Consolidation... either the market is digesting gains or.... waiting for some signal.

Consolidation... either the market is digesting gains or.... waiting for some signal.

many of the other indexes look better than the spx. I was trying to draw some .... pattern to the pattern this evening, and couldn't . I suspect it's a personal failing.

I was trying to draw some .... pattern to the pattern this evening, and couldn't . I suspect it's a personal failing.

Healthy is a slow up move, and not these ridiculous Violent 30 minute 150 pt reversals... but to say it's unhealthy... doesn't mean we can't move higher.

and....

it's the last day of the month, which is naturally bullish. Then there is the friday effect...

now we did see an upmove most of last friday in anticipation of a closing rally and it failed last week... One could think there would be a repeat performance.

Thursday, May 28, 2009

Risk reward and maybe some macro.

The market is interesting here.

Yesterday I heard some bozo say "we are more interested in the late cyclicals, than the early". Tony and I have had this discussion.... and Certainly Maybe I'm wrong.

You need a consumer to buy a new computer, to make the microchips go up, to then make the company build new plants, and to need more materials for new plants and new Computers.

This Hyperinflation trade... makes me think you all are caught in last years bullshit again.... but you swear... it will all turn out better this time... not the fucking train wreck it was last time. All the bullshit you can drop on your foot...

Seems like in that situation, I'm more into buying a gun and some Wheat for the old BombShelter.

But as I sit here.... I wonder where are the growth sectors... what is it that people are going to buy more of over the next few quarters.... I get nothing...

So, like when we get to this last 10 pts on the spx to the 875 level.... I'd play it below there(short)... and play counter to an impulse above there.....

As much as ... I hear all the Bla bla bla in the market, I need a growth theme to invest in.... Not Black Helicopter nonsense, and "Valuations are great"....

It's all risk..... as far as I can see... Sure there is a seasonality play in oil.... but...

get real...

solid volume

I was reading notes this morning... Doug Kass, that dude from CNBC who's private equity firm failed, and Michael Farr... well they are bullish... Sighting that they are contrarian... Jesus Fu#%ing...... and on the bear side is about every other idiot.....

I was reading notes this morning... Doug Kass, that dude from CNBC who's private equity firm failed, and Michael Farr... well they are bullish... Sighting that they are contrarian... Jesus Fu#%ing...... and on the bear side is about every other idiot.....

it's like a horror show of sentiment....

like you care....

Cornet went down... of course she needs to realize she needs to be much stronger... to be an athlete in this day and age and get bye on talent and slight athleticism, isn't going to cut it.

apparently Bartolli lost this morning as well... damn, I slept through that one.

Oh BTW

it was the sell off in the SPX that caused the turn in the Treasuries, I'm not sure what charts everyone else was looking at, but things were trading together Treasuries up spx up, spx down treasuries down.... then the spx sold off and then Treasuries then pushed to the upside.

I also want to point out that since the weekend and all the Dollar armageddon and such.... the dollar has become stronger.

third set tiebreak federer up 5-1

Look Better Please!

alize cornet down a break in the second set, after losing the first pleads with the official to look again at the mark left by the ball on the red clay of Paris....

Federer was down 2 breaks in the third set, after losing 1 set... broke back to even...

TOOO much good tennis at the same time......

Wednesday, May 27, 2009

bearish sectors

airlines

Real estate

construction

furnishings appliances

railroads

insurance-property

household non durable

publishing

financial

Drift

Armageddon is here... I just saw a commercial for Scientology.

Armageddon is here... I just saw a commercial for Scientology.

But i Digress, we have what may be a momentum high, with the slow drift, I'm not sure if we will get a secondary high or not. but maybe we are in for a correction.

The open

I'm having a hard time not shutting it all off and spending the day watching the open today....

Tuesday, May 26, 2009

Week 4!....

I didn't notice the low volume on friday. I could bla bla bla about slight pennants and Flags... But I predict some lemming will say "we are range bound" of course that is the trade from the past 4 weeks.

I didn't notice the low volume on friday. I could bla bla bla about slight pennants and Flags... But I predict some lemming will say "we are range bound" of course that is the trade from the past 4 weeks.

FUCKING HELL!!!

Outside the flag!

Interesting MEMEs over the weekend, Every source I had was talking collapse of T-bills and the Dollar!..... apparently the lemmings have Armageddon at hand! Where is Bruce Willis when you need him! Certainly Ashton Isn't going to help!

Interesting MEMEs over the weekend, Every source I had was talking collapse of T-bills and the Dollar!..... apparently the lemmings have Armageddon at hand! Where is Bruce Willis when you need him! Certainly Ashton Isn't going to help!

Unless you can save the world by Being a Twat!... Er Twit er Twitterer!

(now that was funny! Armageddon to Twit!)

Monday, May 25, 2009

French Open

.... the most interesting thing is that we have 5 different players, all Playing to Lose in the final. For the most part, many of the woman in the draw have a problem with their mental game. So.... the winner will be the one who can convince themselves that they can win.

Sunday, May 24, 2009

Jesus

Sorry... still obsessed with Kitchen Nightmares, Gordon Ramsay shut down the only decent restaurant in a small town on Valentines day... Taped the kitchen up with Caution tape.

French open in 2 hours... or when you read this... it probably started a bit ago...

Saturday, May 23, 2009

Bear Flag

I asked Tony to look for a Forming Bear flag on the 2 day.... here is my 2 day.... I have 2 swings posted

I asked Tony to look for a Forming Bear flag on the 2 day.... here is my 2 day.... I have 2 swings posted

Friday, May 22, 2009

2 fridays

how many fridays have we landed around 880...

It's actually 4... but I think this is the 3rd since we hit the peak....

so...... Third time is the charm....

Seems like some daytraders caught themselves on the wrong side at the close.

But happy Holidays!!!

Weeeee!!!

90.20 is the upside target, 89 is a downside...

90.20 is the upside target, 89 is a downside...

this is the old trade, where early cycle stocks want to go down, and some of the later cycle stocks want to go up. It's a divided market .

my ... No read

so... feels like it's going to break down... but ... I just don't see any conviction sell side.

so... feels like it's going to break down... but ... I just don't see any conviction sell side.

Sideways